Industry size and value

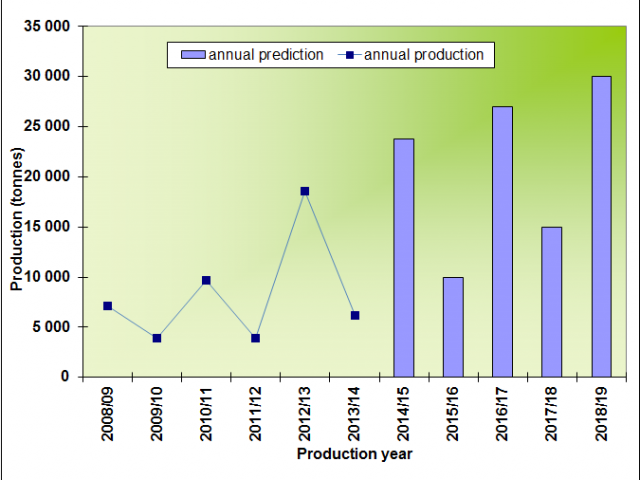

The avocado industry in Western Australia is experiencing significant growth (shown in Figure 1) although irregular bearing of trees can obscure this.

In 2017/18, the WA industry produced 19 236 tonnes (data courtesy of Avocados Australia Limited). The 2017/18 production is slightly down from a few years ago with 22 961 tonnes produced in 2015/16. WA contributes 25% of Australian production while Queensland produces 62% of Australia's avocados. While WA production is down on previous years Australian production is at an all time high of 77 000 tonnes for 2017/18.

In 2012/13 season which produced 21 392 tonnes WA avocados had a farm gate value of $78 million and injected an estimated $120 million into the state's economy (estimated by Department of Agriculture and Food economists).

Varieties and regions

Western Australia predominantly grows the Hass variety (more than 95% of total commercial production), with small numbers of others including Reed, Fuerte, Sharwil, Lamb Hass, Llanos Hass and Bacon.

Significant growing areas include Gingin, Carabooda, Busselton, Manjimup and Pemberton. Smaller plantings are scattered along the coast from Carnarvon in the north to Albany in the south.

Seasonality of supply

Due to the climatic differences of the growing regions, WA avocados can be available all year round. However, with current major plantings the main commercial season runs from August through to February inclusive.

Western Australian avocado production has an entrenched alternate bearing pattern producing a cycle of heavy, light, heavy crop seasons (see Figure 1). The industry is working to reduce the variation in production from season to season.

Avocados can enter Western Australia from interstate and New Zealand under certain import conditions so fresh avocados are always available. This allows a reasonably stable market for avocados in Western Australia.

Markets

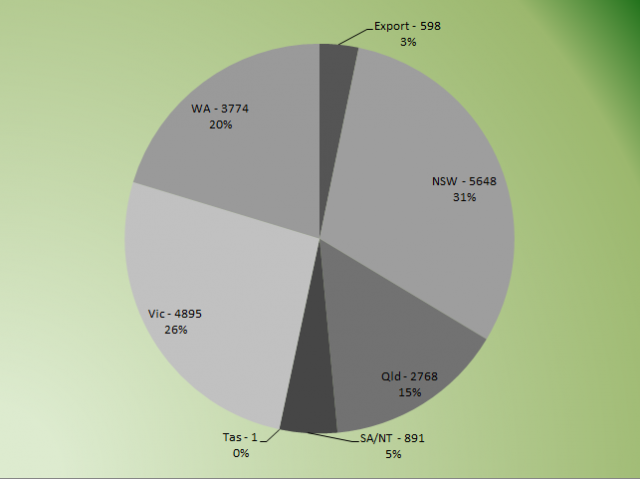

While the local Western Australian market is important, 50 to 80% of production is sold interstate (Figure 2) and a modest but growing percentage is exported to several overseas destinations including Malaysia, Singapore and the United Arab Emirates. For perspective the percentage of exported avocados over all of australia was 2.3% of total production in 2017/18.

Avocado industry bodies

The avocado industry is a member of the Agricultural Produce Commission (APC) in Western Australia. The APC collects and administers funds (‘fee for service’) on behalf of member industries according to statutory regulations.

These funds can then be used by the industry on research and development issues that benefit the industry as a whole. Currently, the avocado industry fee for service is set at zero.

Nationally, the avocado industry is represented by Avocados Australia Limited (AAL). While representing all commercial avocado growers in Australia, AAL is also a ‘paid’ member organisation, and paid members are entitled to increased services. Western Australia is currently entitled to have two elected directors on the AAL board.

AAL is a member of Horticulture Innovation Australia Limited (HIA). All avocado fruit sold from Western Australia (as well as all avocados produced and sold from other areas of Australia) attracts a national levy payment of 7.5c/kg which is collected by HIA.

These funds are collected and administered under statutory law by HIA and used on behalf of the industry for research, development and marketing, based on industry strategic investment plans.

DPIRD involvement

The Department of Primary Industries and Regional Development (DPIRD), formerly DAFWA, has had a long and productive association with the avocado industry.

DPIRD has assisted the industry to develop quality assurance systems, quarantine export protocols for Mediterranean fruit fly, new interstate and overseas markets, and provided research assistance for a range of production issues.

Further information

For more information on avocados please refer to the industry bodies listed above.