Executive summary

Key points

- Knowing your farm’s profit drivers assists you in analysing the ability of the business to withstand adverse conditions, capture opportunities and to make informed expenditure decisions.

- To maintain or increase profits farmers must increase production, attract higher prices and/or lower costs.

- Whilst individually price may be the largest driver of profit, making numerous small changes across the business that cumulatively have a large impact on overall profit may be more achievable.

- Look beyond gross margins and analyse all costs of the business including operating expenses, allowances for capital replacement, management and finance costs.

- Knowing the financial capacity of the business is critical when considering additional debt or capital expenditure.

- Managing the business to limit losses is as important as maximising profit. Therefore understanding the flexibility and resilience of the business’s cost structure is essential.

- There are key management practices and skills that farmers can use to further enhance business profitability.

The vast majority of Western Australian grain, wool and sheep meat is exported. For producers to continue to sell into the export markets they will need to remain internationally competitive. Producers will continue to be challenged as they face rising costs, intensified competition from international producers and climate challenges. To maintain and improve profitability managers of farm businesses will need to have a deep understanding of their profit drivers and have plans and tactical strategies in place to profitably manage their businesses in a range of possible scenarios.

This report outlines the main drivers of profit – price, production, costs and management. Knowing a farm’s profit drivers assists managers to analyse the risk and resilience of their business and to make more informed expenditure decisions. With significant volatility in both prices and production, farm managers need to have strategies that smooth price volatility and allow adjustments to costs of production.

When analysing business profitability it is important to look beyond gross margins and capture all cost items particularly large fixed costs like finance and machinery allowance costs. By critically examining the full cost structure of their business managers can:

- assess the flexibility of their business in different production scenarios

- know the profit implications of pricing decisions

- evaluate expenditure on inputs

- plan more effectively for the future.

Debt can either constrain or support the profitability of a business. Knowing the financial capacity of the business to repay debt is therefore critical when considering increasing debt levels. This means understanding the volatility and reliability of pre-tax profit and how this influences debt repayment.

Profit should be the focus as it is profit that will service and repay the debt, not the value of land. The land value is simply security for the bank to liquidate in the event insufficient profit is generated. When considering debt to fund an investment farm managers should ensure the investment generates a greater return than the cost of the debt and ideally the return should be sufficient to repay the debt within 10-15 years.

High performing farm business managers share some common management practices and skills that further enhance the profitability of their businesses. Surveys of some of WA’s top performing farm business managers highlight they are focused on the business performance as well as the farm operations and have good planning, organisational and tactical skills to profitably manage seasonal volatility.

In this report we have used a case study for a mixed farm enterprise to demonstrate how changes to price, production or costs can impact profit. For most businesses, changes in price will have the largest impact on profit, followed by production then costs. However, to achieve the largest impact on profit overall the best approach is likely to be making small changes across the business. For example, if the manager in our case study could increase both prices received and production by 10% as well as reduce the cost base by 10% the farm business’s profit would double (100% increase).

Additionally in this report we outline suggested management strategies that can be used to improve price, increase production and lower costs to boost profit.

Understanding profit

Profit is simply the income left over after all costs have been paid and is calculated as:

Net profit = Gross farm income – costs

Gross farm income, also referred to as total revenue or gross farm receipts, is typically calculated as price multiplied by production volume sold.

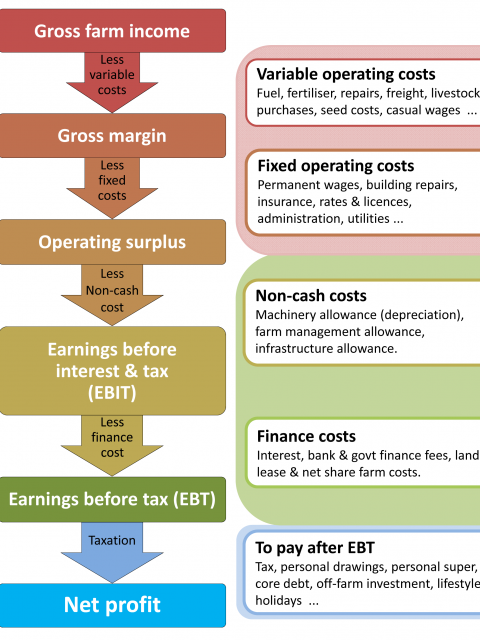

Net profit is gross farm income less all costs associated with production and running the business. Costs include fixed and variable operating costs, allowances for the replacement of livestock, plant and machinery (which may be in the form of depreciation), finance costs (interest, lease costs), management allowances (if a salary is not drawn) and taxation.

Figure 1 shows how net profit is calculated. Many people focus on gross margins, but there are significant costs not captured in the gross margin that need to be factored in when making comparisons across enterprises, analysing profitability and setting price targets.

Analysis across various profit points (that is, gross margin versus operating surplus versus EBIT versus EBT) will depend on the purpose. For example, a farm manager when comparing enterprises may look at the earnings before interest and tax (EBIT) level; when considering expanding the farm area may look at the net profit after tax level; or when comparing crops that have the same fixed costs may look at the gross margin. We typically would analyse at the EBIT profit level to compare across farm business performance as taxation and finance costs will vary depending on the structure and financing of the business, ie family trusts, partnerships, company, debt level etc.

Know your farm’s profit drivers

Profit varies across farm businesses and between years and is driven by changes in price, production and costs. Farm business managers should know how each of these key profit drivers affects their business profit. Understanding this enables key decisions, particularly around returns on investment of time and money, to be made with confidence. Knowing a farm’s profit drivers assists managers to analyse the risk and resilience of their business and make expenditure decisions within a season and between seasons.

It is the capacity of the farmer to effectively manage each of these drivers that determines a farm’s profitability under a range of conditions. Management skill is often the differentiating factor between the top and bottom performers operating in similar environments.

Managing price to drive profit

In most businesses, changes to price have the largest impact on profit, marginally ahead of production volume and costs. This is largely because any increase in price will flow directly into the business as profit net of any sales commissions or levies. In our case study example a 1% increase in price lifted pre-tax profit by almost 4% (refer to the case study for a worked example).

The market price of most grain and livestock products is largely driven by global and local demand and supply fundamentals. Agricultural producers do not ‘set’ the prices they receive. Prices for many agricultural commodities are highly volatile and difficult to predict. They are influenced by the unpredictability of global weather conditions and subsequent impact on global and local production (that is, supply). Prices are further impacted by changes in the exchange rate.

There is opportunity to improve profit through active management of both downside and upside price movements. Any marketing strategy or plan must take into consideration both whole of business cost structures and potential production levels under different seasonal scenarios. This helps identify price ranges to target for your marketing and selling decisions. It also assists with the decision making around opportunities presented by ‘price spikes’ created by uncertainty around global production.

Management strategies available to assist in managing price risk and to improve the average price received include:

Marketing tools and sales strategies

- Increasing your marketing skills and knowledge or seeking professional support.

- Monitoring of the global and local markets, to take advantage of opportunities to sell as they arise, that is, use volatility to your advantage.

- Having marketing plans in place with strategies on how to respond to changes in price and season.

- Forward selling to lock in a favourable price for a proportion of production. However, you need to be confident in ability to deliver the volume of grain/wool/lamb under contract.

- Considering derivatives, such as swaps and options to manage price risk.

- Selling as close as possible to the consumer (direct) to by-pass part of the supply chain and associated costs.

- Selling produce through time, price averaging.

- Targeting niche markets.

- Establishing a brand that is recognisable and associated with attributes desired by the consumer.

- Identifying and, if possible, selling into market windows when prices are typically higher. This may involve changing production schedules (for example, time of harvesting, joining). However, the opportunity needs to be weighed against any additional costs or yield penalties associated with meeting this market window.

- Timing the sale of your product and holding some grain/wool as stock so you can sell if price spikes without production risk. Retain grain/hay as feed if drought occurs and/or don’t get caught being forced to sell in a weak price market. The cost of holding stock needs to be considered including the opportunity cost of what cash could have been invested in.

Production planning

- Using decision support tools like Yield Prophet® to help you to better understand the likely production based on seasonal conditions to date and seasonal outlook.

- Controlling or managing the quality of produce to avoid downgrades or penalties.

- Producing ‘premium’ quality products to improve price (blending grain, grass fed livestock, managing yield/protein relationship).

- Diversifying the enterprise mix to reduce the whole farm profit impact of a significant downward price correction in one commodity.

For more information

Managing production volume to drive profit

Production volume means tonnes of grain or fodder, kilograms of wool cut or number of livestock head produced per hectare. Farm businesses are generally comprised of a variety of enterprises. As the manager you have a critical role in analysing the profitability of various enterprise mixes that may suit your property and personal circumstances. Ensure synergies between the enterprises are captured.

Whilst the weather is a key, but unpredictable, driver of production volume there are some management strategies that assist producers to capture the maximum yield potential available in each particular season. These include:

Systems and management

- Good planning and preparation so that time critical tasks are met. For example, maintaining machinery in good condition to avoid delays and break-downs, quality labour contracted well in advance, critical spares kept in stock on farm, logistics management plans in place during peak periods.

- Have plans in place on what to do if the season outlook and prices change from what was budgeted. Review budgets regularly and adapt to the changes in prices and seasons. For example, if it is a poor season what option is most profitable for your business - fallow, trade sheep, drop a paddock out of crop, leave standing crop etc. If the prospects are for a highly favourable season then examine the feasibility of increasing the crop area, fertilising for a higher yield, increasing the stocking rate on pasture lands and/or maybe consider some crop grazing.

- Become effective users of decision support tools including Yield Prophet®, MyCrop, wheat yield constraint calculator, flower power, DPIRD’s climate and weather maps, lime calculator, supplementary feed budget calculators etcetera.

- Investigate the merits of crop grazing including an increased stocking rate, frost risk mitigation and reduced disease pressure.

- Investigate yield response levels and associated profitability of different rotations.

- Choose varieties and genetics that are most suited to the climatic conditions of your farm.

- Consider a ‘phased’ rotation approach for mixed farming to manage weeds, disease and nutrition for the cropping phase and generate high density pastures to allow higher stocking rates.

- Regularly monitor crops and livestock so that pests, diseases and weeds are detected early and can be treated early or pre-emptively.

- Analyse test results to identify and address any production constraints. For example, conduct soil tests for acidity and nutrient composition so lime and fertiliser can be applied to optimise yield response rates for both crop and pasture.

Cropping

- Summer weed management to conserve moisture, avoid allelopathic impact of weeds, limit seeding hold ups.

- Maintain low weed burdens and prevent weed seed set.

- Use variable rate management of inputs including lime, fertiliser and chemicals to achieve optimum yields on highest quality land and avoid over-applying inputs on less responsive land.

- Investigate the potential benefits of controlled traffic farming.

- Adjust your mix of crops and crop area to the seasonal prospects. This can help lessen costs in poor years but also lifts profits in the best years.

Livestock

- Benchmark your stocking rate and stock at the optimal stocking rate for the region. Analyse returns on a kg wool/ha or kg lamb/ha basis as well as on a per DSE basis.

- Analyse the profitability differences of various lambing dates. Would later lambing provide more food on offer (FOO) and allow higher stocking rates which may more than offset higher weaner feed costs?

- Preg-scan ewes to separate the multiple-lamb ewes and increase their supplementary feed to lift condition score and increase marking rates. Separation also avoids over feeding of single ewes, which can increase both feed bills and lamb mortality due to dystocia (difficult births).

- Maintain ewe condition from joining through to lambing to optimise lambing percentage, aiming to achieve the same condition score at lambing as at joining.

- Regularly monitor pasture utilisation to make nutrition decisions.

- Consider lupin flushing for ewes to increase ovulation rate of the ewes and potentially provide additional nutrition to the ewe to accommodate a potentially higher lambing percentage.

- Adopt good ram management by inspecting rams prior to joining, stocking at minimum 2% rams and consider using teasers if joining merinos prior to Christmas to stimulate ewes to cycle.

- Lick feeders.

- Reduce post birthing lamb losses to predators such as foxes.

For more information

- Yield Prophet

- Lifetime wool

- Mycrop

- Wheat yield constraint calculator

- Weed seed wizard

- Flower power

- Seasonal climate information

- GRDC

- MLA

- Variety sowing guides

Managing costs to drive profit

Farm business managers must understand their cost structures, know breakeven production volumes required to cover all costs and have strategies in place to curb expenditure when it looks like production targets may not be met.

Costs can be fixed or variable. Fixed costs are expenses that the business will incur regardless of the season or volume produced. They include both fixed operating and non-operating costs such as permanent wages, overheads, depreciation and finance costs. Variable costs are direct input costs that vary with the season or volume produced such as fuel, repairs, fertiliser, livestock purchases, supplementary feed, animal health, seed, casual wages, freight costs, levies etcetera.

Given the variability in seasonal conditions, farm businesses need to have strategies in place to manage their cost structure. This provides for the flexibility to maximise production opportunity through additional expenditure in the favourable seasons and minimise costs in the poor seasons.

A farm business with a high proportion of fixed costs is at greater risk in areas of volatile seasonal production than a business with low fixed costs. Businesses with low fixed costs are able to buffer a series of low return years more easily. Farm business managers need to be acutely aware of this when considering additional land, machinery or other capital purchases as the interest and capital allowance expenses will be incurred regardless of how favourable future seasons are.

Assessing business decisions

Farm business managers should calculate the return on investment (ROI) for every option when considering an investment decision.

Return on investment (ROI) = profit / cost of investment

When considering an investment in a new technology or upgrade calculate the expected cost savings or increased production value first so you can work how much you can spend to justify the investment or the payback period of the investment.

Payback period = cost / annual net benefit

Capital costs – machinery and livestock

Matching capital investment to the needs of the business

Grain enterprises are becoming more capital intensive as larger, more expensive and technologically advanced machinery is being released. The amount of funds invested in plant and machinery should be commensurate to the size of the farm, otherwise there is a risk of overcapitalising the business. When reviewing the profitability of an enterprise always factor in a replacement allowance for the machinery. For example, if the business replaces the cropping machinery every five years allocate 20% of the current cost of replacing the machinery to the costs when evaluating the performance of the cropping enterprise.

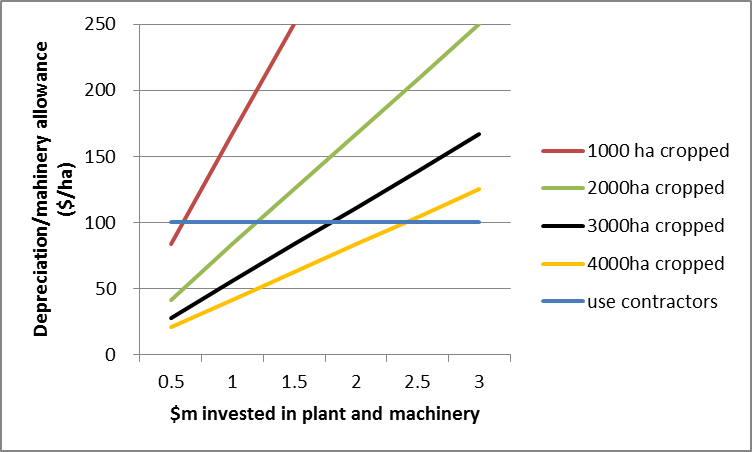

The chart below is a simplified example of the cost per hectare of a range of machinery investments across different cropping areas assuming the business replaces its machinery every six years which equates to a depreciation rate of 17% per annum. It also includes the option of employing contractors for seeding and harvest assuming a rate of $100/ha.The chart highlights the intersection point for each crop area scenario where the manager may be better off contracting or downsizing machinery than upgrading.

For example, a 2000ha cropping program that replaces its machinery, worth $1.5m (replacement value), every six years would incur $125/ha ($1.5m/6/2000) in annual machinery allowance/depreciation costs. Notwithstanding other benefits associated with ownership (eg fewer delays) on a pure cost comparison it would be 20% more cost effective for this enterprise, in this example, to use contractors that cost $100/ha than own equipment worth $1.5m that is replaced every six years (cost $125/ha).

Whilst every crop needs to be seeded, sprayed, fertilized, harvested and carted there are ways of reducing the machinery cost of the business. These include:

- hiring contractors

- buy second hand machinery

- share machinery with other grain growers (syndicate ownership)

- lease more land using the same machinery to lower the per hectare cost

- hire additional labour to use machinery for more hours in day (for example, at seeding work around the clock)

- improve logistics efficiency (for example, use of chaser bins, trucking contractors)

- provide contract services to other growers to increase earnings from the machinery.

Often a blend of these options will be most profitable for the farm business.

Sheep enterprises also have capital replacement costs in the form of flock replacement. For example, if you keep ewes for five years ensure you allocate 20% replacement value as an annual cost to the enterprise in profit evaluation if turning off 100% lambs. If you retain 20% lambs as ewe replacements this amount is captured via reduced sales income (ie 80% lambs sold instead of 100%).

Other capital items with much longer useful lives include water infrastructure, fences, sheds, yards etc.

Finance costs

Is debt assisting or constraining profit growth?

Debt can only assist a business if the business can generate a higher profit, net of finance costs, than it could without the debt. Ideally, the business should be able to repay debt in 10-15 years.

Interest coverage ratio is a useful ratio to determine how easily a business can pay interest on outstanding debt. The interest coverage ratio is calculated by dividing the earnings before interest and taxes (EBIT) by the interest expenses of the same period:

Interest coverage ratio = EBIT / interest expense

A ratio under one means that the business is having problems generating enough cash flow to pay its interest expenses. In general terms, many farm business would want the ratio to be over three as this will most likely indicate the business is generating sufficient cash flow to pay interest, tax, make small debt repayments and fund personal expenses (drawings). Note that this assumes depreciation is reflective of machinery replacement costs over their useful life. Interest cover above four will often mean there may be cash flow available to upgrade or replace machinery and pay down debt faster.

Earnings volatility must also be considered in evaluation of the Interest Coverage Ratio. The higher the earnings volatility the higher the interest cover should be to ensure interest costs can be paid in the poor years. If the interest coverage ratio is above three it means that earnings (EBIT) can fall by two-thirds and interest can still be met assuming interest rates do not change. However, there would be no cash flow available to meet debt repayments, personal expenses or machinery upgrades.

Equity is the percentage of owned assets. It is calculated as total assets less total liabilities divided by total assets. The table below compares how variations in equity percentage can impact profit for a 2000ha farm business that has a total asset base of $7m and, on average, generates $250/ha in EBIT. This table shows that at 60% equity this farm would take approximately 21 years to repay the debt from after tax and drawings earnings. By comparison lifting equity to 70% increases net profit after tax and drawings (NPATD) by 23% and debt would be repaid within 13 years under the same interest and earnings assumptions.

| % equity | 60% | 70% | 80% |

|---|---|---|---|

| Debt per ha ($/ha) - property is 2000ha | 1400 | 1050 | 700 |

| EBIT ($/ha) | 250 | 250 | 250 |

| Less interest @ 6% ($/ha) | 84 | 63 | 42 |

| Less tax @ 30% ($/ha) | 50 | 56 | 62 |

| Less $100 000 drawings ($/ha) | 50 | 50 | 50 |

| Net profit after tax and drawings (NPATD) ($/ha) | 66 | 81 | 96 |

| EBIT interest cover (EBIT/interest @ 6%) | 3.0 | 4.0 | 6.0 |

| Approximate years to pay off debt from earnings after drawings and tax | 21 | 13 | 7 |

The more debt laden the business, or lower the equity percentage, the more sensitive the profit is to changes in interest rates. The results in Table 2 highlight the sensitivity of profit to small changes in interest rates. The example in Table 2 shows that if equity is 60% an increase in interest rates from 6% to 7% results in profit after tax and drawings (NPATD) declining by 15%. If this same business had 80% equity the NPATD impact of the same rise in interest rates would be 5%.

| % equity | 60% | 70% | 80% |

|---|---|---|---|

| Net profit after tax and drawings $/ha (at 7% interest) | 56 | 74 | 91 |

| % change in net profit after tax and drawings with interest rates rising from 6% to 7% | -15% | -9% | -5% |

| EBIT interest cover (EBIT/interest @ 7%) | 2.6 | 3.4 | 5.1 |

| Approximate years to pay off debt from earnings after drawings and tax | 25 | 14 | 8 |

The table also highlights how rapidly the repayment period escalates as interest rates increase for a business with lower equity. For instance, if the business had 60% equity and interest rates rose from 6% to 7%, the time it would take to repay the debt would increase from 21 years to 25 years. By comparison, the business at 80% equity would take eight years to repay its debt compared to seven years at the lower interest rate of 6%.

Earnings are also highly volatile in farming businesses largely due to price and seasonal volatility. Table 3 shows the impact a decline in EBIT from $250/ha to $200/ha has on NPATD and debt serviceability. It shows that a business with 60% equity would experience a 53% decline in NPATD to $31/ha which restricts funds available to pay back the debt so the payback period more than doubles to 45 years if EBIT continued at this lower level. By comparison, if the business had 80% equity the $50/ha contraction in EBIT sees NPATD fall by 36% and the payback period stretches to 12 years from seven years.

These results also display the importance of maintaining high equity percentages and/or high and consistent EBIT to grow a farm business.

| % Equity | 60% | 70% | 80% |

|---|---|---|---|

| Debt per ha ($/ha) | 1400 | 1050 | 700 |

| EBIT ($/ha) | 200 | 200 | 200 |

| Interest $/ha @ 6% | 84 | 63 | 42 |

| Less tax @ 30% | 35 | 41 | 47 |

| Less $100,000 drawings ($/ha) | 50 | 50 | 50 |

| NPAT and drawings ($/ha) | 31 | 46 | 61 |

| EBIT Interest cover (EBIT/interest @ 6%) | 2.4 | 3.2 | 4.8 |

| Approximate years to pay off debt from earnings after drawings and tax | 45 | 23 | 12 |

Working capital costs and cash flow management also need to be considered with finance costs. Generally a working capital line of credit (overdraft) attracts higher interest rates than term debt. If a business is incurring higher interest charges for an overdraft consider increasing the term debt facility limit at lower interest rates with an offset account. This will allow the business manager to draw down funds during peak debt periods at lower interest rates and, once income is received, deposit it in the offset account so interest costs do not accrue.

Typically, mixed farm enterprises receive revenue three times a year, being the grain, wool and sheep meat revenue. As such, mixed farm enterprises have much lower working capital costs than cropping only enterprises which can wait 10-12 months for payment. This cash flow needs to be considered when comparing costs of different enterprise mixes. There are options available to assist smooth cash flow and reduce peak debt such as pre-payment, progressive payments and deferred payments. The costs associated with these need to be weighed up against any savings in finance costs. The implications on taxation also need to be considered.

Management strategies to reduce finance costs include:

- find out what terms other financiers may offer your business

- re-negotiate terms with existing financiers

- restructure the debt (for example, replace overdraft with cheaper term debt and add an off-set account)

- offer the lender more security in exchange for lower interest rates

- fix interest rates to mitigate risk of rising interest rates

- replace debt with equity

- sell land and lease land under certain terms and market conditions

- change payment terms for debtors and creditors

- repay debt.

Fixed operating costs (farm overheads)

Farm overheads include rates, licences, water, administration etc. They represent about 5% of total farm costs and thus small changes have a small impact on overall farm profit. Nevertheless, there are management options to reduce fixed overhead costs including:

- Review insurance policies – are you over insuring the value of your crop, plant or machinery? Can you withstand some risks? Shop around to other insurance brokers. Use your networks to compare value.

- Licences – see if there are options for concessional licences.

- Water, power, internet, phone – costs are a function of usage. Select appropriate plans. Regarding water regularly check for leaks in pipes/troughs that need fixing.

- Consider employing casual administration support to keep accounts and records up to date. Good organisation and presentation of records should reduce time charged by consultants and accountants. Furthermore, administrative support will allow you to allocate more time to reviewing & analysing the accounts to evaluate the performance of the business and make further operating and investment decisions to improve profit performance.

- Leasing more land may spread some of the fixed costs eg. consultant, accountancy fees.

Variable operating costs

Inputs

Input costs include fertiliser, chemicals, seed, fuel, repairs and maintenance, supplementary feed and animal health products.

As these costs are variable, and therefore discretionary, farm managers should know the additional return likely, being the farm gate value of the additional production, from each additional dollar spent. If the additional production response, this year and future years (if appropriate), is not likely to be sufficient to cover the additional input cost consider not expending funds.

Some options to reduce and manage input costs include:

Systems and management

- Monitor the season and budget regularly, that is, monthly/fortnightly, to match spending to production potential as the season unfolds. Implement a plan of action for a variety of seasons and be flexible to avoid overspending in the poor/dry years or underspending in the favourable years.

- Seek out quality advice from specialist advisors, field days, training events and other farmers.

- Focus on additional return (or savings) on investment of the additional expenditure. Do not include costs already incurred or revenue that would have been received regardless of the additional investment.

- Rotation can reduce costs of weeds and disease as well as the risk of resistance.

- Legumes and pastures can reduce the need for nitrogen fertiliser in the following year; but weed control in the following crop can be a challenge.

- Reduce waste, for example install auto-steer technology to avoid overlap and thereby reduce costs of fertiliser, chemicals, fuel and time (labour);

- Calculate feed budgets to available pasture and calibrate trail feeders to prevent over or under feeding.

- Use decision support tools to make informed decisions regarding inputs, particularly nitrogen, phosphorous, potash and trace elements.

- Put in place effective strategies to manage resistance, particularly weeds, worms and other pests and diseases.

- Consider tendering out your business each year with suppliers.

- Consider bulk buying for a discount, or if a smaller business try bulk-buying with other farm businesses. Shop around.

- Ensure action is timely. For example monitoring crops and treating earlier (when rates, and therefore costs are lower) rather than later when the disease/pest/weed has spread or is more advanced. Be pre-emptive in your approach and strike early. Effective monitoring helps enormously with this approach.

- Find cheaper ways of doing things. For example, look for substitutes, new technology, consider sharing expensive equipment that is not time critical to operations.

Crop specific

- Increase efficiency or optimising returns (production response) on inputs – for example soil testing and implementing variable rate management techniques so that more fertilizer can be applied to areas where the yield response rates will be highest and reducing application rates where response may be limited due to another limiting constraint.

- Regularly service plant and equipment to reduce delays to time critical tasks, lower repair and maintenance costs and/or fewer breakdowns at critical times.

- Apply treatments as specified on the label and don’t scrimp. When treating weeds, diseases and pests in crops and animals always apply adequate rates to achieve the highest levels of control possible. If not, resistance or re-infection may develop and therefore further treatment costs are incurred.

- Make sure the boomspray, spreader etc are calibrated correctly.

Sheep specific

- Incorporate precision feeding – assess supplement quality, calibrate feed carts to monitor how much sheep are offered, assess pasture quality and availability, condition score animal, set targets for different classes of animals, feed budgeting to determine what supplementation is needed to achieve targets.

- Preg-scan ewes to identify dry/single/multiple-lamb ewes - separating the dry, single and twin ewes so that feed rations match energy requirement to maintain condition thereby optimising feed costs as well as maximising lambing percentage.

- Consider using contractors – reduce costs of plant repairs and maintenance and frees up you time to do other management tasks.

Post farm-gate selling costs

Post farm gate costs can be one of the largest expenses for a farm business totalling around $100/ha for some mixed farm businesses. These costs include freight, commissions, levies and royalties and account for around 15-20% of total costs. They will vary depending on production volume.

A grain grower 200km from port will typically pay around $54/t in levies, receival fees, freight and port fees to CBH in WA. As prices are quoted free in store (FIS) port fees are already deducted from the prices so the direct out of pocket expenses are in the order of $30-35/t. On an individual grower basis these fees are set by CBH and not negotiable.

Ways of lowering post-farm gate costs for your farm business include:

- Understand the fee structure of alternative supply chains.

- Evaluate the costs of storing on farm and freighting during non-peak periods. Storage and holding costs need to be considered in this evaluation. It is also important to ensure that you monitor price movements to ensure that value does not significantly change.

- Seek out alternative supply chain paths to market, for example selling direct to customers, abattoirs or container exporters to avoid additional supply chain costs such as agent fees.

- Investigate using on-farm storage and contracting with a trucking company for freight.

- Set up a contracts or arrangements with freight companies so that logistics can be efficiently managed.

- If possible, backload inputs.

- Levies are mandatory and royalties depend on the grain variety. Not much can be done at an individual producer level to reduce these.

Labour and time management

Spending time on your business is considered by many to be as important as spending time in your business. Planning, monitoring and analysing the performance of the farm business is critical in assisting the farm manager to make informed and tactical decisions on how to spend his/her time and money to maximise profit.

Be wary of doing an operational task yourself ‘to save money’ instead of getting someone in. It can be more expensive in the long run if it means you haven’t got the time to spend on business planning, monitoring and management. Having effective time management in both the business and operations areas of the farm is a key skill requirement of successful farm business managers.

Labour sources for farm businesses can be in the form of contractors for specialised tasks (for example, shearing, crutching), casual and full time employees. Labour costs vary considerably depending on farm size, enterprise mix and machinery investment.

Measures can be taken to increase efficiency of labour to reduce labour costs of employees on an hourly/daily rate. For example:

- Have a logistics management plan during peak periods to avoid staff/contractors downtime or ‘waiting’ for something to happen or someone to do something.

- Be well prepared prior to the events or upcoming operations ensuring everything is in working order and all equipment and consumables are in supply and available.

- Invest in multi-skilling staff, particularly full time staff.

- Ensure adequate training and material is provided to new/less experienced staff to avoid mistakes and improve efficiency.

- Communicate effectively with staff so everyone knows what is planned and expected to happen.

- Provide feedback to staff to improve productivity and reduce risk of errors/mistakes/accidents.

- Ensure the mix of contract, casual and full-time labour matches the business needs to avoid underutilising labour.

- Consider investing in technology that may reduce employee injury or mistakes, eg. sheep handling equipment, auto-steer, ban mobile phones for certain operations to avoid risk of accidents.

- Ensure machinery is in good working condition and sheep are ready (drafted in yards) to allow contractors/casuals to work as productively as possible.

Taxation

Profitability should drive investment decisions, not taxation or incentive schemes. Paying tax means the business is profitable, which is a good thing. Saving tax generally means you are reducing profit. Ensure you understand the implications of any tax management strategy you have in place on the financial flexibility of the farm business. Seek advice from appropriate qualified professionals.

How much tax a business pays depends on its profitability, the business structure and how actively the farm manager manages taxation whilst maximising net profit after tax. Some tax management strategies include:

- manage the timing of income and expenditure, for example, deferring income or bringing forward expenditure

- use farm management deposits (FMD’s)

- establish superannuation accounts, including self-managed superannuation funds

- use family trust structures

- split or average income

- acquire essential plant and equipment

- consider investment gearing

- consider government allowances/rebate schemes

- seek out further tax and financial planning advice, particularly if you’re not completely satisfied with the services provided by your current accountant or financial planner

- always keep after tax profit in mind when making a decision.

For more information see the department's farm management deposits (FMDs) page or visit the Australian Taxation Office website.

Management skills of high performing farm business managers

Similar farms facing the same market conditions can often generate vastly different returns under different owners as management expertise can be a key driver of profit. There are some common behavioural traits of managers of top performing farm businesses which also lead to higher profitability. In general, they are good planners and organised. They review budget to actual expenses/yield regularly through the season and adjust plans accordingly. They are tactical decision makers and are focussed on return on investment when making expenditure decisions.

DPIRD and GRDC commissioned Planfarm to write two reports, 'Bridging the Yield Gap, a survey of high profit farmers, 2011' and 'How to farm profitably in the Eastern Wheatbelt, 2014' which compared the management strategies of the top 25% most profitable farm businesses to the average. Some key behaviours and characteristics of the most profitable farm manager mentioned in these reports are summarised below. WA’s top farm business managers:

Plan and prepare

- are focused on getting big decisions right

- are good planners and able to convert planning effort into well organised and efficient results

- make key decisions on large capital items outside pressure periods

- are well prepared for key operational tasks

- have a very integrated approach to farming that matches their property

- have training and succession plans in place.

Are analytical decision makers

- Are disciplined on financial and operational management practices with a focus on budget/cost control and return on investment.

- Are in control of their business, can accurately assess the impact of a decision and therefore can make and act on decisions rapidly. Planning assists this.

- Have the ability to match inputs to the season, may have similar yields to the ‘average’ some years but with lower costs therefore higher profits.

- Have a conservative attitude to risk and not early adopters of new technology preferring to wait to see if it suits their business.

- Are always listening for new ideas to improve business performance.

- ‘Don’t do it alone’ and they have mentors or close friends to bounce ideas off.

Have the following operational characteristics

- have good communication with family and staff

- are committed, are attentive to detail and do the job properly

- have passion for their business

- actively manage soil constraints and adopt integrated weed management systems.

Conclusion

It is the effective management of price, production and costs that drive profit. Whilst price is generally the leading profit driver by a small margin, effective management of all three profit drivers is essential. Every business has different cost structures and essentially the smaller the profit the larger the profit impact (in percentage terms) of small changes in each of the profit drivers. The more diverse the business the smaller the profit impact is of any one price or production shock, thus creating a more resilient business through the cycle.

Farm businesses should critically assess their cost structure and its flexibility under different seasons and through a series of seasons, to gain a better perspective of how reliably the business can generate profit. Once the cost structure and profit resilience is well understood decisions on appropriate debt levels and price targets can then be made without unduly jeopardising the health of the business.

There are number of strategies adopted by farm business managers to manage price, costs and production volume and some of these have been discussed in this article. Furthermore the management and organisational behaviours of the top performing farm business managers illustrate what is required to ensure business success.

To find out more information on managing your profit drivers contact your farm advisor, planner, accountant, banker or attend training workshops such as the Planning for Profit workshop run by DPIRD.

Case study – Mixed farm business in medium-high rainfall region in WA

What is the largest driver of profit - price, production or costs?

To help answer this question we use a case study as an example being a 2500ha mixed farm business operating in the medium/high rainfall area of south west WA to demonstrate how changes in price, production and costs impact profit. Our case study business is a 50/50 crop/sheep enterprise mix. The sheep enterprise is running merino ewes crossed with a terminal sire and 100% lambs are being turned-off (sold). The crop enterprise’s average wheat yield is 2.8t/ha. The assumptions on revenue and costs underpinning our case study analysis are summarised in Appendix A.

Management decisions that deliver small favourable changes in price, production and costs can significantly improve profit. If the case study farm business was able to adopt management changes that achieved a 1% increase in price, a 1% increase in production and a 1% decline in costs (excluding finance) the business’ profit would increase by over 10%. Put another way, a 10% improvement across all three variables would double the farm’s before tax profit. If your business currently generates a before tax profit of less than $191/ha the percentage impact on profit of 1% changes across these variables would be even higher.

| Mixed farm 50/50 crop/sheep | Profit before tax and drawings $/ha | % impact on profit |

|---|---|---|

| Base case* | 191 | - |

| 1% increase in price (grain, wool and lamb) | 198 | 3.9% |

| 1% increase in production ( wool cut, marking rate and grain yield) | 197 | 3.5% |

| 1% decrease in operating costs | 196 | 2.4% |

| 1% decrease in capital allowance costs (machinery and livestock) | 192 | 0.6% |

| combination 1% everything (revenue and production up 1%, operating costs and capital allowance down 1%) | 211 | 10.4% |

| Impact of finance: | - | - |

| Interest rates rise 1% (from 6.5% to 7.5% @ 79% equity) | 181 | -5.3% |

*See Appendix A for cost and revenue assumptions underpinning the base case pre-tax profit.

We found similar results for a cropping only business operating in the region with price being the largest profit driver.

Stocking sheep at optimal levels for your region is recommended as long as there are tactical plans in place to modify labour, feed rations and stock numbers to accommodate changes in the seasonal conditions. Strategic plans around stocking rates that flex with the season will increase profit. Increasing stocking rates to optimal levels will have an additional labour cost or management requirement which needs to be considered and costed in. Be aware of ‘management stretch’ of trying to do too much yourself and ensure other business enterprises are not adversely impacted.

We have assumed the sheep enterprise is running at an optimal stocking rate for the medium-high rainfall area at nine Dry Sheep Equivalent/Winter Grazed hectare (DSE/WGha). If your sheep enterprise is stocked at lower than optimal rates a lift in stocking rate may be a key driver of profit. If stocking rate was sub-optimal in our case study, say 10% lower at 8.1DSE/ha, pre-tax profit would fall by approximately the same percentage (9.6%), assuming supplementary feed costs do not change. If however, feed costs fell by 10% due to the 10% lower stocking rate net profit would fall by 7.6%. Therefore it is still more profitable to stock sheep at optimal levels.

Price

Investing time in managing price risk, both upside and downside, is essential to maximising profit. In our case study price had the largest impact on profit, marginally ahead of production volume and costs. In the case study, every 1% increase in price lifted profit by 3.9%. Note that if your farm business profit/ha is lower than our case study farm business then changes in price are likely to have a larger percentage impact on your profit.

| Commodity | Wool | Lamb | Grain | Combined |

|---|---|---|---|---|

| Price - base case | $11.50/kg clean | $4/kg | Wheat $300/t FIS | - |

| Profit before tax - base case* | 191 | 191 | 191 | 191 |

| Profit before tax - after 1% price increase | 192 | 193 | 195 | 198 |

| % change in profit before tax | 0.5% | 1.3% | 2.1% | 3.9% |

*See Appendix A for cost and revenue assumptions underpinning the base case pre-tax profit.

In general, for our 50/50 mixed farm case study business operating in the current market, changes in grain prices had a similar impact on profit as changes in sheep (lamb and wool combined) prices. For the mixed farm business in our case study, a 1% increase in grain prices led to a 2.1% increase profit while a 1% change in lamb and wool prices had 1.3% and 0.5% impact on profit respectively (1.8% combined impact).

Production

In our case study a 1% increase in the volume of grain, wool and lambs in the mixed enterprise results in a 3.5% increase in profit, assuming neither further increases in costs nor decline in quality.

| Variable | Wool cut | Lambs marked | Wheat yield | Combined |

|---|---|---|---|---|

| Production - base case | 5kg/hd | 90% | 2.8t/ha | - |

| Profit before tax - base case* | 191 | 191 | 191 | 191 |

| Profit before tax - after 1% price increase | 192 | 193 | 194 | 198 |

| % change in profit before tax | 0.5% | 1.2% | 1.9% | 3.5% |

*See Appendix A for cost and revenue assumptions underpinning the base case pre-tax profit.

Changes in grain yield had a slightly larger impact on farm profit than the same percentage changes in marking rate or wool cut per ewe in our mixed farm business case study. We found that a 1% increase in grain yield increased profit by 1.9% whilst a 1% increase in production in the sheep enterprise, being lamb marking rates and wool cut, had a 1.7% increase in profit. When breaking down the sheep enterprise further we found that changes in marking rate (from 90%) had double the impact on profit as similar percentage changes in kilograms of wool cut (from 5kg/head).

Note that if your pre-tax profit is lower than that of our case study of $191/ha the profit impact of increasing production volumes, in percentage terms, will be higher.

Costs

In our farm business case study a 1% reduction in all costs (including finance) led to a 3.3% increase in profit. Costs that have the biggest impact on profit, and where managers need to apply rigorous discipline, are cropping input costs, capital replacement allowance (machinery and livestock replacement) and finance costs.

A breakdown of the profit impact of a 1% reduction in each cost item for our case study farm business is summarised in the table below. Please note the assumptions behind the costs are summarised in Appendix A.

| Medium-high rainfall 50/50 crop/sheep enterprise | Base case $/ha | Pre-tax profit impact of 1% reduction in costs |

|---|---|---|

| Total revenue | 821 | 821 |

| Fixed operating costs 1 | 67 | 0.3% |

| Variable operating costs 2 | 285 | 1.5% |

| Post farm gate selling costs 3 | 102 | 0.5% |

| Capital replacement allowance 4 | 110 | 0.6% |

| Finance costs 5 | 67 | 0.3% |

| Total costs | 631 | 3.3% |

| Net profit before tax | 191 | 197 |

- Fixed operating costs include administration, insurance, rates, water and one full time equivalent employee (manager’s allowance $70 000).

- Variable operating costs include crop and pasture inputs, shearing, crutching, mulesing contractors, feed and animal health costs.

- Post farm gate costs include freight/cartage, receival charges, commissions and levies.

- Capital replacement allowance is calculated at 12.5% equipment value (replaced every eight years) and 20% ewe flock value (we assume 100% lamb turn off and ewes kept for five years).

- Finance costs are calculated at 6.5% term debt and 7.5% on working capital on a balance sheet with 79% equity.

In summary, price is the largest driver of profit in our case study, followed by production followed by costs. If the business manager could increase the prices received by 10%, increase production volume by 10% without incurring higher costs, and reduce the cost base by 10% this farm business’s profit would double. Some strategies to how to work towards achieving this are highlighted throughout this report.

Appendix A – Revenue and cost assumptions for the mixed 50/50 crop/sheep business case study

| Variable | Assumption | Unit |

|---|---|---|

| Effective Ha | 2500 | ha |

| Land value | 3000 | $/ha |

| Average useful life of plant and equipment | 8 | years |

| Capital available (debt + equity) | 11.1 | $m |

| Plant and equipment | 0.9 | $m |

| Livestock | 0.4 | $m |

| Land | 7.5 | $m |

| Debt | 2.3 | $m |

| Equity (net assets) | 6.5 | $m |

| % equity | 79% | % |

| Wheat/barley yield | 2.8 | t/ha |

| Wheat price Free-in-Store (FIS) | 300 | $/t |

| Grain handling farm to port costs (Cartage, receival, freight, EPR, levies, cartage) | 46 | $/t |

| Lamb price for 22kg cwt | 88 | $/hd |

| Wool price clean | 11.50 | $/kg |

| Ewe price | 50 | $/hd |

| Ewe stocking rate | 6.5 | ewe/winter grazed ha |

| Dry Sheep Equivalent (DSE) stocking rate | 9.8 | DSE/winter grazed ha |

| Wool cut/ewe | 5 | kg/ewe |

| Ram % | 2 | % flock |

| Marking rate | 90 | % |

| Income and costs | $/ farm ha | Assumptions |

|---|---|---|

| Grain income | 420 | 2.8t/ha x $300/t x 50% farm area |

| Lamb income | 257 | 6.5 ewe/ha x 90% marking rate x $88/hd x 50% farm area |

| Wool income | 112 | ewes and rams 5kg x 65% clean x 90% clip x $11.50/kg |

| Culls | 33 | 20% flock at $50/hd |

| Total income | 821 | - |

| Farm overheads | 39 | Rates, licences, water, elec, gas, admin, insurance, buildings, fences |

| Seed and treatment | 14 | 85kg/ha + 10% pasture farm @ $30/ha + treatment @ $50/t |

| Fertiliser and lime | 95 | Fertiliser: 20kg MOP (2500ha), 55kg Urea (625ha), 110kg Urea (625ha), 55kg DAP (1250ha), 100kg Super (1250ha); plus cartage $23/t. Lime: $40/t x 25% land area |

| Chemical | 36 | Planfarm Bankwest Benchmarks |

| Fuel and oil | 30 | Planfarm Bankwest Benchmarks |

| Plant repairs | 13 | 4% machinery value |

| Permanent labour | 28 | 1 x FTE @ $70 000 including super |

| Casual labour | 4 | $30/hr for seeding at 6ha/hr and harvest at 9ha/hr |

| Contract shearing | 23 | $7/ewe (includes shed hands, work cover and super) |

| Contract crutching | 6 | $0.80/ewe/lamb 4% work cover + 9.5% super |

| Contract marking | 5 | $1.30/lamb + $0.20/hd ear tag +4% workcover +9.5% super |

| Supplementary feed - ewes | 31 | 270g/day barley or equivalent for six months at farm gate price |

| Supplementary feed - lambs | 10 | 30% lambs sold in nov (not supp feed); 70% lambs feed for two months @400g/day |

| Animal health | 17 | Drench: Ewes $0.80/h (two drenches) + lambs $0.60/h (inc vitamin E). Lice $1.40/hd; Jet $0.25/hd. Vaccine lambs @ marking $0.50/hd + vac&drench $0.50/hd |

| Cartage | 68 | $3.70/hd freight and yard fees, $8/t grain cartage, wool freight $11/bale + cost of wool pack ($12.50each), CBH receival and freight charges $31.50/t |

| EPR, levies, commission | 34 | EPR $3/t. 2% AWI levy, MLA min 2% sale value or $1.50/hd, DPIRD biosecurity $0.12/hd, 1.02% GRDC levy. 4.5% wool selling fees, 5.5% sheep selling fees |

| Depreciation/machinery allowance | 44 | Machinery replacement value ($0.9m) / eight year replacement cycle / farm area |

| Sheep purchases | 65 | 20% rams @ $1000/hd + 3% death replacement of ewes + 20% maidens (ewe replacements) @ $70/hd |

| Finance costs | 60 | 6.5% interest on term debt |

| Working capital costs | 7 | Cost of inputs, feedcosts and overheads carried for four months at 7.5% interest |

| Total costs | 631 | - |

| Net profit before tax and drawings | 191 | Equivalent to $477 103 over the 2500ha farm |

| Profit margin | 23% | Profit before tax and drawings /total income |

| Return on equity | 7% | Pre-tax profit divided by equity $6.5m |