Understanding profit

Profit is simply the income left over after all costs have been paid and is calculated as:

Net profit = Gross farm income – costs

Gross farm income, also referred to as total revenue or gross farm receipts, is typically calculated as price multiplied by production volume sold.

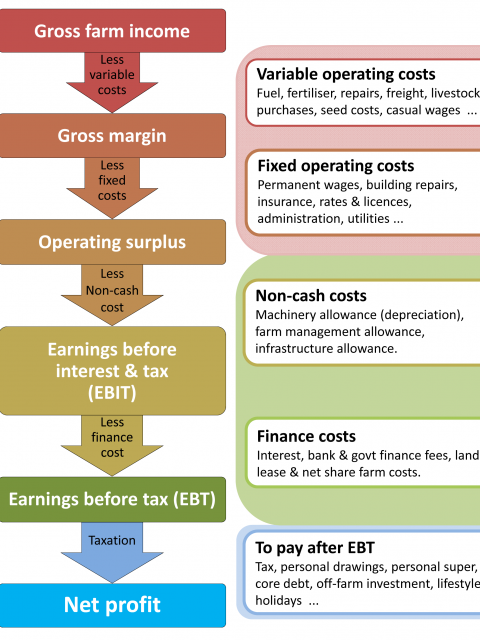

Net profit is gross farm income less all costs associated with production and running the business. Costs include fixed and variable operating costs, allowances for the replacement of livestock, plant and machinery (which may be in the form of depreciation), finance costs (interest, lease costs), management allowances (if a salary is not drawn) and taxation.

Figure 1 shows how net profit is calculated. Many people focus on gross margins, but there are significant costs not captured in the gross margin that need to be factored in when making comparisons across enterprises, analysing profitability and setting price targets.

Analysis across various profit points (that is, gross margin versus operating surplus versus EBIT versus EBT) will depend on the purpose. For example, a farm manager when comparing enterprises may look at the earnings before interest and tax (EBIT) level; when considering expanding the farm area may look at the net profit after tax level; or when comparing crops that have the same fixed costs may look at the gross margin. We typically would analyse at the EBIT profit level to compare across farm business performance as taxation and finance costs will vary depending on the structure and financing of the business, ie family trusts, partnerships, company, debt level etc.