Capital costs – machinery and livestock

Matching capital investment to the needs of the business

Grain enterprises are becoming more capital intensive as larger, more expensive and technologically advanced machinery is being released. The amount of funds invested in plant and machinery should be commensurate to the size of the farm, otherwise there is a risk of overcapitalising the business. When reviewing the profitability of an enterprise always factor in a replacement allowance for the machinery. For example, if the business replaces the cropping machinery every five years allocate 20% of the current cost of replacing the machinery to the costs when evaluating the performance of the cropping enterprise.

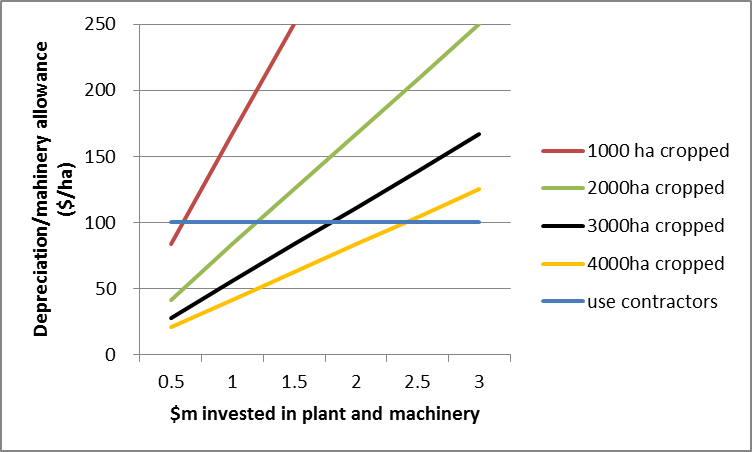

The chart below is a simplified example of the cost per hectare of a range of machinery investments across different cropping areas assuming the business replaces its machinery every six years which equates to a depreciation rate of 17% per annum. It also includes the option of employing contractors for seeding and harvest assuming a rate of $100/ha.The chart highlights the intersection point for each crop area scenario where the manager may be better off contracting or downsizing machinery than upgrading.

For example, a 2000ha cropping program that replaces its machinery, worth $1.5m (replacement value), every six years would incur $125/ha ($1.5m/6/2000) in annual machinery allowance/depreciation costs. Notwithstanding other benefits associated with ownership (eg fewer delays) on a pure cost comparison it would be 20% more cost effective for this enterprise, in this example, to use contractors that cost $100/ha than own equipment worth $1.5m that is replaced every six years (cost $125/ha).

Whilst every crop needs to be seeded, sprayed, fertilized, harvested and carted there are ways of reducing the machinery cost of the business. These include:

- hiring contractors

- buy second hand machinery

- share machinery with other grain growers (syndicate ownership)

- lease more land using the same machinery to lower the per hectare cost

- hire additional labour to use machinery for more hours in day (for example, at seeding work around the clock)

- improve logistics efficiency (for example, use of chaser bins, trucking contractors)

- provide contract services to other growers to increase earnings from the machinery.

Often a blend of these options will be most profitable for the farm business.

Sheep enterprises also have capital replacement costs in the form of flock replacement. For example, if you keep ewes for five years ensure you allocate 20% replacement value as an annual cost to the enterprise in profit evaluation if turning off 100% lambs. If you retain 20% lambs as ewe replacements this amount is captured via reduced sales income (ie 80% lambs sold instead of 100%).

Other capital items with much longer useful lives include water infrastructure, fences, sheds, yards etc.