With increasing global demand for protein sources but a shrinking Western Australian (WA) sheep flock, the WA industry may not be able to meet future market demand for sheepmeat, forcing buyers to go elsewhere or to other sources of protein. The challenge for the industry is to adopt change and cut costs in the supply chain, allowing more of the retail dollar to flow back to farmers to stimulate production.

A new business model may be the solution. It would need to address the objectives of:

- economies of scale

- farm productivity improvement

- capital attraction

- new value chain design.

Why is a new business model needed for the WA sheepmeat industry?

The current industry structure is a market supply/demand model, and is based on each link of the supply chain working on a commodity basis with volume determining company profitability. Every time the product changes hands, someone adds cost that either the consumer or farmer pays. The fundamental problem of the sheepmeat industry in WA is that producers’ returns are perceived as insufficient and unsustainable, reducing production volumes and testing industry viability.

Global demand for sheepmeat is rising. There is an estimated 76% global increase in protein required in the next 35 years. Meat and Livestock Australia (MLA) forecasts growth of lamb exports of 19% and mutton of 11% for the Australian sheep industry over the next five years to 2020.

Despite demand predictions, there has been a continual decline in WA flock numbers, from a high of 38.4 million in March 1990 to an estimated 13.0 million in July 2016 with the breeding flock estimated at 7.53 million in July 2015. There are a number of factors causing this long term downward trend in flock numbers:

- low industry confidence

- insufficient returns – a lack of profitable contracts available

- climate change - unreliable winter rains, more variable summer rain

- an ageing farmer population, with an average age of 53; 25% of which are over 65

- a low acceptance of sheep farming by the younger generation

- average farm debt of the Australian lamb producer is approximately $600 000, limiting expansion capability

- cropping seen as less risk, higher return, more reliable and less work.

Addressing continuity of supply of sheepmeat would benefit the WA sheepmeat industry. Where supply chain continuity is compromised, subsequent price shocks can negatively impact farming families, scare off investment capital and put industry survival and growth at risk.

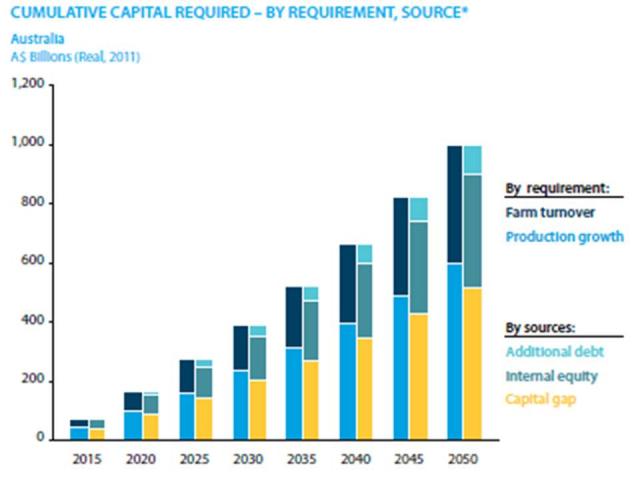

Substantial growth-oriented capital is needed in Australia over the coming decades to grow agricultural exports and to support older farmers who wish to exit the sector, allowing the next generation of farmers to buy them out. However the traditional sources of finance for farmers, debt and retained earnings, are insufficient to support maximum growth potential and farm turnover (Figure 1).