The full report is now available from the link on the right of this page. This page summarises the findings in the report.

Sheep management and profitability advice

- 23% of consultants considered that sheep can provide significant value to a cropping enterprise, 60% said ‘it depends’ and 17% are of the opinion that sheep add no value or are a hindrance to a cropping system.

- The majority of consultants (+80%) were very or quite willing to recommend these practices:

- group and manage ewes according to their nutritional requirements during pregnancy and lambing (88%)

- renovate pastures or feed base systems (85%)

- run a higher stocking rate or increase pasture utilisation (85%)

- monitor the health of ewes through condition scoring (82%)

- conduct pregnancy scanning of ewes to determine litter size (82%).

- 81% of agribusiness were willing to advise their clients to compare the profitability of sheep and cropping, and to invest in infrastructure to improve sheep management.

Consultants observations on producers attitude to the sheep

- 44% of agribusiness have witnessed clients increasing their sheep flock, 50% say that flocks are roughly staying the same and 6% have clients that are downsizing or getting out of the sheep industry.

- Consultants believed that producers would benefit from a deeper knowledge of objective measurement, business analytical skills and opportunistic cropping interactions.

Needs of the industry

- Respondents indicated that the three top barriers to producers increasing their flock or getting back in to sheep are:

- the (real or perceived) long-term profitability of the sheep enterprise

- the labour intensive nature of a sheep enterprise and impact on lifestyle

- the risk of maintaining a higher stocking rate in variable years.

- Consultants said that a general lack in investment in the sheep industry, such as in technology development and research and particularly in comparison to cropping, has led to lack of confidence in producers that the sheep industry is competitive and dynamic, and that producers need consistent high prices, such as through forward pricing, to grow their flocks.

SIBI’s role in the sheep industry

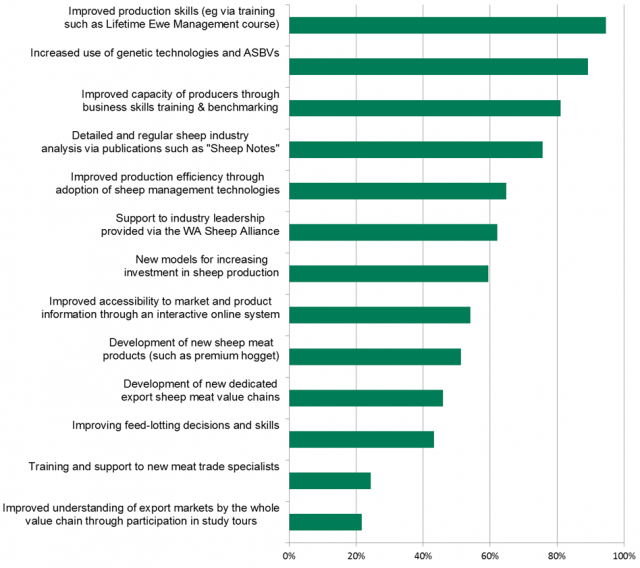

- When asked about the services that SIBI provides, 95% of respondents believed that supporting producers to improve their production skills is important. More than 80% of respondents believed that increasing the use of genetic technologies and Australian Sheep Breeding Values (ASBVs), and improving producers business and benchmarking skills, are also important activities for SIBI (Figure 1).

- Consultants were asked about where they get their sheep management information from and how familiar they were with the activities of the SIBI project. The main points were:

- 71% got sheep management information from the Department of Agriculture and Food, Western Australia (DAFWA, now known as the Department of Primary Industries and Regional Development) and 74% recommend DAFWA information and tools to clients

- 70% were familiar with the SIBI project, with 27% of these with a good understanding of SIBI’s objectives.

- The activities of the SIBI project related to improving producer capacity attracted comprehensive support from the consultants surveyed. Product development and marketing also attracted strong support. There was very little support expressed by consultants for value chain development. Consultants believe that DAFWA needs to strengthen its investment in research and development that will effectively progress the sheep industry.

Among the respondents were 20 farm business consultants, seven sheep production specialists, seven finance specialists, three crop specialists and one unspecified.