Introduction

Western Australia (WA) has a herd of approximately two million head of beef cattle distributed throughout the state.

For the past five years the WA beef herd has remained relatively stable. Over half of the WA beef herd is made up of breeding cows and heifers with the remainder comprising of bulls, steers and calves.

WA's herd is distributed between the northern and eastern rangelands and southern agricultural regions. The state's herd is almost evenly distributed 50:50 between the rangelands and agricultural regions.

With a National herd of 22.3 million head of beef cattle and calves (2015/16), Australia's total value of beef production (including live exports) was $A13.1 billion with a production of 2.1m tonnes of beef and veal (Australian Bureau of Statistics (ABS)).

In comparison, Western Australia's beef production is on a much smaller but not insignificant scale. The total value of the WA beef industry is A$857.4 million which includes the live export industry, domestic consumption and boxed beef exports (both chilled and frozen).

In 2016, WA turned-off a total of 757 000 head of cattle with approximately 347 000 head of cattle for live export (A$400m), 64 000 tonnes for domestic consumption and 41 000 tonnes carcase equivalent of processed beef exported either as frozen or chilled boxed product (A$171m).

Australia exports most of its beef and veal production with 72% exported in 2016 (ABS data, DPIRD analysis).

WA exports only one third of the beef produced with the other two thirds being consumed domestically.

Export market growth represents a significant opportunity and is a sector where the WA government is supporting bi-lateral investment to develop integrated value chains.

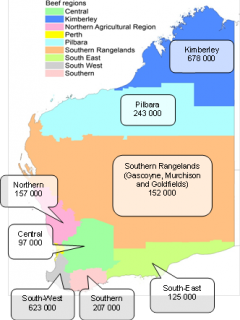

The WA cattle herd is distributed between extensive pastoral stations in the north and east of the state and smaller, more intensive farms in the Agricultural Region in the south-west of the state. The distribution of the WA herd in each of the regions is shown in Figure 1.

The WA beef industry is comprised of approximately 4000 cattle businesses with 25% owning more than 500 head of cattle (ABS 2010/11).

The 500 largest cattle producers own more than 75% of the state’s herd.

By number, the largest herds are located in the northern part of the state in the Kimberley region.

The distribution and size of cattle properties across the state is largely determined by the productivity of land types, climate and pattern of rainfall distribution.

Properties in the pastoral or rangelands region are generally significantly larger than southern properties and predominantly run Bos indicus (Brahman type) cattle. The majority of these properties in the pastoral region are leasehold. Cattle are grazed on native grasses and shrubs. Stocking rates are typically range from 1–3 cattle units (CU) per square kilometre (a standard cattle unit is equivalent to a 400kg steer at maintenance).

Properties in the Southern Agricultural Region tend to be smaller in size than the pastoral region with many being mixed enterprises with cropping and livestock.

These properties operate with higher stocking rates due to more reliable rainfall, longer growing season and better quality forages.

Cattle are predominantly Bos taurus (British breed) with stocking rates typically between 1–3 CU/hectare.

Cattle are grazed on improved pastures including annual rye grasses, subterranean clover and sub-tropical perennial grasses.

Figure 1. Distribution of the WA cattle herd by region (source: ABS 2011 and PLB 2013).

Climate and geography of Western Australia (WA)

The climate of WA is defined by seasonal rainfall distribution (Figure 2).

The South-West of WA has a Mediterranean climate with cool wet winters and hot dry summers.

Agricultural beef production tends to occur in the higher rainfall regions (Figure 2, turquoise area).

The state’s grains industry is based in the drier agricultural regions integrated with livestock production.

The Mediterranean climate zone covers approximately one quarter of WA’s land area and has an annual average rainfall between 300–1200mm (Figure 3).

The growing season varies from 5–9 months.

The central coastal and arid regions of the state receive lower rainfall (Figure 2, yellow area).

The climate is characterised by cool winters and hot summers.

Rainfall ranges from less than 200mm to over 500mm annually near the coast (Figure 3).

While rainfall can occur during winter, annual rainfall is often dominated by monsoonal rain associated with cyclones and large tropical lows.

The far north of the state (Figure 2, orange area) is characterised by summer dominant rainfall.

Summers are hot and wet with high humidity and cyclonic rainfall while the winters are cool to warm and dry. Annual rainfall can vary from between 400–1500mm and is highly variable (Figure 3).

Pastoral production systems

The Rangelands (pastoral region) of WA are divided into five regions with the majority of the cattle located in the Kimberley and Pilbara regions.

| Region | Number of stations | Average station area (hectares) | Maximum station area (hectares) |

|---|---|---|---|

| Kimberley | 93 | 230 406 | 480 859 |

| Pilbara | 57 | 229 831 | 431 180 |

| Carnarvon-Gascoyne | 80 | 149 405 | 398 389 |

| Murchison | 125 | 176 602 | 406 489 |

| Goldfields-Nullarbor | 89 | 207 851 | 595 322 |

There are a total of 444 pastoral stations in WA as of July 2015 with an average area of 196 000ha and a carrying capacity of almost 2600 cattle units (a standard cattle unit is equivalent to a 2.25-year-old, 450 kg B. taurus steer maintaining W and walking 7 km/day. Using the existing NRDR (2007) equations, the energy requirement of this standard animal at zero weight change is 73 MJ ME/day. A diet energy density of 7.75 MJ/kg DM (equivalent to 55% DMD) is assumed. McLennan, McLean & Paton (2020).).

Most rangeland grazing properties are managed as pastoral leases on government-owned (crown) land.

The administration of WA’s pastoral leases is the joint responsibility of the Pastoral Lands Board (PLB) and the Minister for Lands.

The Kimberley region has some of the largest pastoral stations and herd sizes due to its relatively reliable rainfall and sustainable native pasture base.

The productivity of pastures and variety of land types differs greatly in the pastoral region and as a result properties are much larger in size than southern beef properties which have more intensive pasture systems and higher stocking rates.

Cattle in the north of the state have been selected to suit the environmental and climatic conditions and the majority of herd have some degree of Bos indicus genetics.

Cattle breeds range from pure Brahman herds to Bos indicus infused breeds such as Droughtmaster and Santa Gertrudis to predominantly Shorthorn and Hereford herds.

In the Kimberley and Pilbara, traditionally the most popular cattle breed has been the Brahman cross. Recently there has been increasing interest in transitioning to composite breeds or Bos Indicus cross content in order to improve carcase traits and increase market access options.

The main mustering period in the Kimberley and Pilbara regions is between April and October (dry season) due to seasonal conditions.

Wet weather during the summer months (November to March) can restrict road access to properties making cattle movement difficult and restricting market access.

With adequate prior planning cattle can be supplied all year round by moving cattle to readily accessible locations throughout the state through backgrounding and integrating turn-off between the northern and southern production regions.

The Northern Agricultural region is one area that is used to background pastoral cattle in preparation for export during the spring and summer months of the year.

Some pastoralists are exploring the use of centre pivot irrigation to grow improved tropical pastures such as sorghum and cowpea on short rotations for production of hay or haylage to fill feed gaps.

Stand and graze pastures under irrigation are also being considered.

These new production systems require government approvals on leasehold land.

Key products and markets

WA produces cattle for live export and processed boxed beef for domestic consumption and export.

Almost two thirds of the 657 000 head of cattle turned-off in WA in 2016/17 (Figure 6) was processed in local abattoirs with the remaining 257 000 head exported live to various markets around the world.

WA produces high quality beef products suitable for restaurant and food service and has one of the highest compliance rates (92.3% in 2014/15) according to Meat Standards Australia.

High quality products (both grain-fed and grass-finished) are available and there is a growing interest for a certified organic beef industry.

WA also produces beef suitable for other uses including manufacturing specifications.

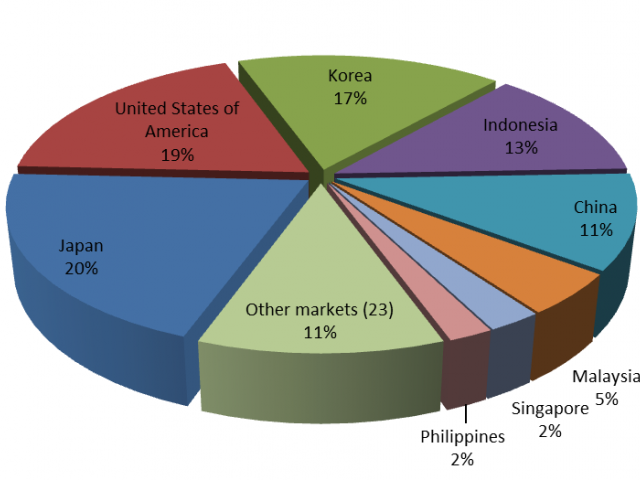

The main boxed beef markets supplied by WA include Japan, the USA, Korea and Indoneasia (Figure 4).

Sixty five percent of the beef processed in WA is consumed domestically and the remaining portion is exported to more than 30 countries throughout the world.

WA’s diverse climate and production systems produce a range of beef products suitable for most market specifications. WA has a well-developed and sophisticated live export industry with a number of live export companies based in WA.

In previous years, WA has exported more than 350 000 live cattle per annum. WA is well placed to supply a diversity of cattle types and breeds to existing and emerging live cattle export markets.

The cattle exported meet a variety of specifications including light young bulls, steers and heifers (less than 350kg), slaughter-ready cattle (more than 450kg) and high quality breeding animals for beef and dairy.

Both Bos indicus and Bos taurus cattle are exported live from WA.

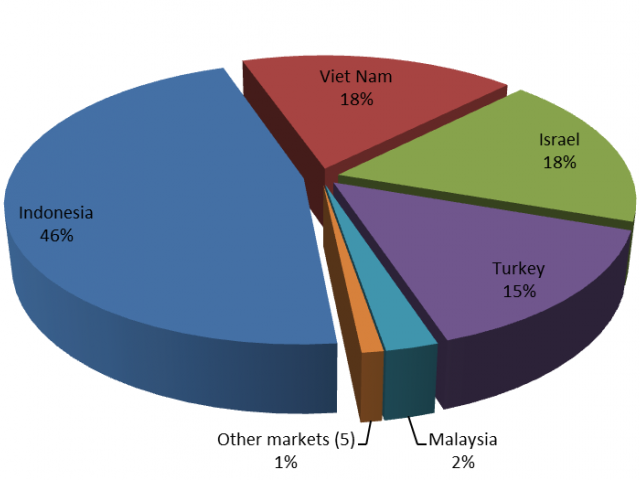

The main export markets for WA live cattle in 2016/17 were Indonesia, Viet Nam, Israel, Turkey and Malaysia (Figure 5).

WA has a proud 100 year history in live exports and Australia is the most experienced and largest exporter of live animals in the world.

WA has an enviable clean animal health status and a world class individual animal identification and lifetime traceability (National Livestock Identification System) that allows the strictest biosecurity protocols to be achieved.

Agricultural production systems

Property size in the agricultural production regions varies widely in response to rainfall and land capability.

Lower rainfall areas have significantly larger properties with generally lower quality pastures resulting in low carrying capacity.

The total herd size in the agricultural region in 2010/11 was approximately 1.2m with more than 55% of the herd in breeder enterprises.

Herd size for stand-alone commercial beef operations in the agricultural region ranges from 500–5000 head.

The main breeds used in this region are predominantly Bos taurus including both British and European breeds and their crosses.

Angus is one of the most popular breeds while Hereford, Murray Grey, Shorthorn, Charolais, Simmental and Limousin are also widely found.

Calving generally takes place between February and August with most calves being sold from December to February as yearlings (10-12 months of age).

Most cow/calf producers sell through either direct contract with processors, live exporters and feedlotters or at the local saleyards.

Over the past 10–15 years there has been a broadening of the feed base in the agricultural region, with the inclusion of new pasture and forage systems to complement traditional annual subterranean clover and ryegrass-based pastures.

Species are strategically matched to soil and climatic conditions to maximise fodder production.

The most significant change is an increase in the use of perennial pasture species and the greater utilisation of out-of-season rainfall allowing longer grazing opportunities.

Productive perennial pastures reduce the need for supplementary feeding during the autumn feed gap typical of Mediterranean climates, in addition they have increased production from poorer sandy soil types that are unsuitable for cropping.

Valuable forage species include kikuyu, tagasaste, lucerne, panic and Rhodes grass.

Profitable producers tend to have a lower cost of production and generate higher revenue.

The higher revenue has been generated through producing more kilograms of beef per hectare per mm of rainfall rather than achieving a higher price per kilogram.

Benchmarking data has shown that efficient pasture utilisation is a key to producing more beef at a lower cost. The top 25% of beef producers are producing 50-60kg more beef per hectare than the average (210kg/ha (liveweight)).

Backgrounding

Cattle backgrounding is the practice of moving weaned cattle from breeding properties to a secondary property in order to prepare them for specific markets.

Cattle may be backgrounded to grow weaners (less than 200kg) through to feedlot entry weight (more than 350kg) or to relocate cattle on a property that is more accessible for transport to market.

Many cattle from the pastoral region are transported to backgrounding properties in the Northern Agricultural region in preparation for live export out of Fremantle port or entry into feedlots in the south for domestic processing.

The backgrounding industry in WA is not as well developed as it is in other parts of Australia and this represents a significant opportunity for development and investment.

Many properties in the agricultural region have perennial pastures that could be used to value-add to pastoral cattle and provide a continuous supply to live export, feedlots and abattoirs.

Backgrounding has the potential to become a key step in an integrated supply chain scenario and could provide important efficiencies and advantages to both live export and slaughter markets to deliver consistency of cattle and annual scheduling of supply.

Feedlotting

The WA feedlot sector has the capacity to feed more than 100 000 head of cattle at any one time and could potentially feed 400 000 cattle each year.

Due to current market requirements, the sector’s capacity is underutilised with only 70% of this capacity used in any quarter of the year.

Feedlotting in WA has the advantage of access to abundant sources of grain and fodder from the local grain industry in addition to the advantage of low freight costs due to short distances between grain sources and feedlots.

The WA wheatbelt region also offers the advantage of a drier climate which reduces the impact of environmental issues such as odour and effluent treatment.

Most WA feedlots operate under the voluntary National Feedlot Accreditation System which monitors compliance with animal welfare, environment, biosecurity, food safety and product integrity legislation and standards.

WA feedlots are world class and highly efficient.

Investment in feedlotting capacity could make a valuable addition to any integrated export supply chain.

Transport

WA has a highly efficient transport system for live cattle, boxed beef and commodity products.

Cattle are routinely transported over long distances by road from pastoral areas of the state to agricultural properties, feedlots, abattoirs and ports.

In remote areas ‘road trains’ with double deck trailers are permitted and allow cattle to be transported safely and efficiently over long distances.

Smaller combination trucks are used to transport cattle from farms and feedlots to abattoirs and ports in southern regions.

WA has a number of ports that are suitable for exporting both live cattle and containers of chilled and frozen beef.

Fremantle is the state’s largest port and handles the majority of processed beef exports and a large proportion of live cattle shipments.

The ports of Geraldton, Port Hedland, Broome and Wyndham are also used for the export of live cattle.

Processing

WA has 12 privately owned beef processing plants including five with accreditation for international export.

Only two plants currently have Chinese accreditation; however others are in the process of gaining Chinese accreditation.

The three largest processors with multiple export market accreditations are located in the South-West of WA.

In 2016/17, 374 000 cattle were slaughtered in WA abattoirs.

In the past, in excess of 500 000 cattle have been processed in one year.

In addition to the currently operating abattoirs, there are a number of plants that are not in operation.

These plants have the potential to be brought into service through purchase or new joint ventures. Land is also available to develop new greenfield site abattoirs.

A beef processing facility situated on Kilto Station in the west Kimberley is the only northern pastoral region beef abattoir in Western Australia. This commenced operation in September 2016. Livingstone Beef abattoir which is located 50km south of Darwin, also provides WA pastoralists with an alternative to live export, particularly for cull animals that do not meet market specifications.

Soft infrastructure

WA live cattle and beef products are underpinned by world-class, evidence-based quality assurance systems that ensure identification and traceability, product integrity, and animal and welfare health status.

These systems include the National Livestock Identification System (NLIS), Livestock Product Assurance (LPA), National Residue Sampling Program (NRS), Pasturefed Cattle Assurance System (PCAS), AUSMEAT standards for meat processing, Meat Standards Australia (MSA), Exporter Supply Chain Assurance System (ESCAS) and national and state-based animal health professional networks (including NATA accredited animal health laboratories).

These systems are enhanced by commercial companies and enterprises that operate quality assurance programs and market specification driven branded products.

WA has many supply chains for both domestic and export products, and the relative scale of the industry lends itself to relatively short supply chains from production to end-user.

This in turn enables potential investors to more readily influence market specifications and product lines suited to their customers.

Investment attraction for industry growth

The Western Australian Government welcomes and facilitates agreements and partnerships between local and in-country agribusiness.

The state government aims to actively promote and profile the WA beef industry in order to attract transformational and innovative investment.

This includes development of new business models that attract bilateral investment to support integrated supply chains from production through to processing and marketing and distribution to end markets.

Investment in the WA beef industry provides investors with a range of options and levels of involvement – from cattle production to integrated supply chains for both live cattle and beef products including the development of innovative beef products.

WA has a strong track record in live cattle exports which includes various breeds and cattle types from purebred Angus produced in southern WA to robust Brahman and their crosses from the northern rangelands.

Cattle exported live from WA are produced to meet strict animal welfare requirements, customer specifications and animal health protocols.

An integrated supply chain involving cattle bred in the rangelands or pastoral areas, linked to backgrounding and finishing operations in the southern grain growing regions for final processing in an abattoir offers a proven value chain.

This value chain approach ensures continuity of supply and specified product quality for end consumers.

Beef production can be based on lower cost breeding stations in the pastoral areas where herds in excess of 5000 are available.

Value can be added through backgrounding and high quality feedlots (to optimise Meat Standards Australia high quality grades) and processed to buyers' specification in modern, multi-market accredited abattoirs.

Investors in an integrated supply chain concept can receive cattle from the wider WA beef sector thus multiplying the potential production through the system.

Southern agricultural feedlot options also exist for investors.

The Department of Agriculture and Food, Western Australia can assist potential investors with links to the WA commercial sector and provide information that could be used to inform their investment decisions.

All foreign investors and their advisers need to be familiar with the Australian Government Foreign Investment Review Board (FIRB) policies.

All foreign government investors must obtain foreign investment approval before acquiring any interest in rural land, regardless of the value. This is consistent with the Federal Australian Government’s longstanding practice.

From 1 March 2015, privately-owned foreign investors must get prior approval for a proposed acquisition of an interest in rural land where the cumulative value of rural land that the foreign person (and any associates) already holds exceeds, or immediately following the proposed acquisition is likely to exceed, $15 million (FIRB, 2015).

Western Australia has a strong agricultural research and development base, including networks linking universities, government and specialist research centres.

Competitive advantages

Western Australia has many competitive advantages as a location for beef production, processing and exporting to target markets.

These include:

- production of high quality, safe, traceable, eco-friendly, ethically produced beef

- high cattle health status, free from major transmissible diseases, backed by supply chain quality assurance programs

- availability of a large range of cattle breeds and pasture types used to convert the natural feed base into beef

- size of the WA beef industry provides for relatively short supply chains ensuring a responsive capability to customer needs and product specifications

- a variety of climate zones enabling reliable year-round supply from Mediterranean climates in the south to semi-arid rangelands in the Mid West to sub-tropical savannah in the north

- production benchmarking provides reliable cost estimates for different production models

- a safe and low sovereign risk investment environment with Australia ranked number five on the index of Economic Freedom World Ranking – 2016

- long standing trade and supply relationships with Asian and foreign market customers that purchase approximately 70% of WA’s agrifood exports

- shares the same time zone with many Asian countries.

Northern Beef Futures

Northern Beef Futures was a $15 million project investment by the State Government’s Royalties for Regions program to transform Western Australia’s northern beef industry through improving markets, businesses and productivity.

The Northern Beef Futures project commenced in August 2014 and ceased on 31 October 2017 to assist pastoralists, exporters and processors to meet the growing beef demand from greater Asia. It aimed to:

- increase the value of production from the Kimberley and Pilbara beef industry

- reduce reliance on current markets through the establishment of alternate, economically viable beef export markets

- increase employment levels in the northern cattle industry.

The project has evolved and is now Northern Beef Development.