Effectiveness of the Scheme

A total of $175 656 in contributions to the Cattle Industry Funding Scheme were received during 2013/14.

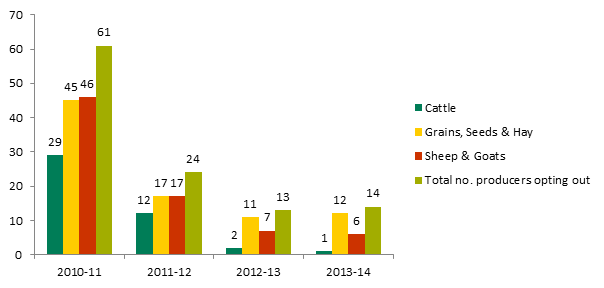

Only one producer opted out of the Scheme in 2013/14, compared to 12 producers who opted out in 2011/12 and 29 in 2010/11 (Figure 1). The extremely low opt-out rate may be indicative of the value of the Scheme to the WA cattle industry.

The producer that opted out of the Scheme in 2013/14 applied for a refund of their contributions. This refund amounted to $101.

An analysis of the 2013/14 Cattle IFS contributions indicates a satisfactory collection rate. The analysis uses sales and export data from the Australian Bureau of Statistics, Department of Primary Industries and Regions SA, Western Australian Meat Industry Authority and the National Livestock Reporting Service to estimate the number of ‘chargeable sales’ that have taken place during the year. It must be noted that there are limitation to the analysis, as data to estimate the total number of chargeable sales is not available for:

- private sales (for example, farmer to farmer); and

- interstate sales whereby cattle are moved out via Kununurra or the Tanami Road.

This means the number of chargeable sales will always be underestimated.

For 2013/14, the estimated number of cattle sales on which IFS contributions were payable was 789 205. Contributions were paid on 878 282 cattle during the year (that is, 111%).

Owing to the difficulties in accurately estimating the number of chargeable sales, the IMC regularly monitors the contributions being paid to the IFS to ensure the regular and correct remittance of contributions from agents and processors.

The IMC would like to stress that the owners of stock sold to persons other than agents or processors (for example, to exporters or to other producers) are required to pay the IFS contributions, as per the regulations.