The benefits of increasing sheep numbers

Why invest in more sheep?

- The demand from our existing markets for WA sheepmeat is very strong and the WA industry is currently having difficulty in sustainably meeting this demand.

- With a rising middle income population globally the demand for protein will continue to increase in the future, creating further opportunity for the profitability and long-term viability of the WA agriculture sector and the sheep sector in particular.

How will investing in more sheep benefit WA regions and agribusiness?

- A sheep production sector that can reliably meet demand will build confidence in the industry’s future. This will lead to ongoing investment and industry development (including maintenance and upgrading where needed), giving producers, employees and communities confidence while helping to sustain domestic and export markets.

- The agribusiness sector will benefit from increased investment in the regions as a result of the increased confidence generated by the sheep sector and its flow-on effects.

- A sustained and increasing throughput of sheep will result in an increased need for service providers and allied supply chains to manage the increased volume. The strong multiplier effect created by this environment will result in these businesses providing great benefit to WA.

What is the typical flock size in a Western Australian sheep enterprise?

- There are 13.8 million sheep and lambs in WA (2016). The sheep industry contributes almost half of the gross value of agricultural production from all livestock industries in WA. This is made up of $661 million for wool and $513 million for sheepmeat (including live exports).

- Details on the makeup of the sheep flock and the value and quantity of products from the sheep industry can be found on the sheep industry page on the DAFWA website. A dedicated newsletter called Sheep Notes provides a twice-yearly snapshot of the industry.

- The average flock size is larger in the medium rainfall zone than the cereal-sheep zone for both wool production (2240 versus 1671 ewes) and meat production (1367 versus 1042 ewes). Data is from the Western Australian sheep producer survey held in 2011 and 2014.

- Information on the primary enterprise type, mating types, source of rams and use of ASBVs in the 2011 and 2014 surveys can be found in the June 2015 edition of the Ovine Observer while information on parasite control and management can be found in the December 2015 edition of the Ovine Observer. The full report can be found here.

Is the sheep sector stable and is there urgency to act now?

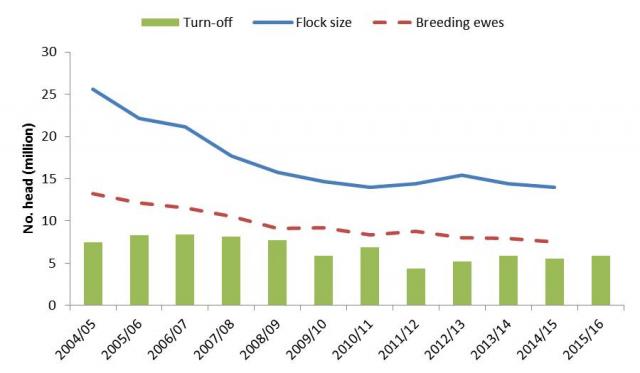

- Yes, there is urgency to act now because annual turnoff from the sheep sector has repeatedly exceeded production resulting in declining flock numbers in recent years. Turnoff is now at or below a level that can sustain the existing processors and exporters. Any further reduction in sheep numbers may limit the ability of the industry to meet the market demand, with subsequent risks to existing markets and there will be fewer marketing opportunities for sheep producers.

- Ultimately the size of the export market prospects highlights the opportunity to increase flock numbers to capture these opportunities. Greater numbers of sheep will result in more efficiencies and greater profitability across the industry.

Will increasing sheep production reduce the price of sheep?

Currently the sheep industry is unable to meet existing demand and emerging markets for WA sheepmeat so the risk of the price of sheep falling is small. To keep and build on these markets sheep production needs to increase. In the long term sheep prices can be sustained with increased production by securing further markets.

Figure 1 Closing number of sheep and lambs, and closing number of breeding ewes in WA and total turn-off for WA (Based on Australian Bureau of Statistics (ABS) data, Department of Agriculture and Food, WA (DAFWA) analysis)

- Loss of markets may occur through product substitution, by other proteins replacing sheepmeat, synthetics replacing wool, and domestically-imported sheepmeat replacing WA lamb. For further information on sheep market trends please view the December 2016 Sheep Notes publication.

- The rapid population growth of wealthy citizens in key markets such as the Middle East and China provides great opportunities for the WA sheep industry. However, to secure these markets the industry has to be able to reliably and sustainably produce the product and avoid these markets being filled by competitors.