The Sheep Industry Business Innovation (SIBI) project

What is SIBI and what is the project priority?

- The SIBI project is a Department of Agriculture and Food, Western Australia (DAFWA) initiative to support the sheep industry by capitalising on growing markets for sheep products.

- SIBI is supported by the state government’s Royalties for Regions program.

- The main priority of the SIBI project is to create a more profitable and resilient sheep industry tuned to customer needs and greater value.

- This priority is being achieved through the establishment of dedicated export supply chains, increasing on-farm productivity, improving farm business skills, attracting investment and establishing resources for research and adoption.

Is DAFWA still involved in sheep research?

Ongoing research is vital and sheep research in the department is focused on increasing the efficiency and profitability of the sheep industry. The SIBI project is focused on transformation of the sheep industry so it can better meet the needs of markets and businesses, and traditional on-farm research is not part of the outcomes funded by Royalties for Regions. However, there are some key programs that contribute directly to the SIBI outcomes:

- The Katanning Research Facility is home to the genetic resource flock. As part of a larger Meat and Livestock Australia (MLA) program, the flock is used for research into the development of Australian Sheep Breeding Values (ASBVs) for a variety of hard-to-measure traits. The traits include carcase traits, breech-strike resistance and lamb survival. The breeding values allow producers to make targeted genetic gains, improve sheep welfare, increase lamb survival and breed meat sheep to market specifications. An economic analysis of the benefit of the genetic resource flock to the Western Australian (WA) sheep industry is being completed to demonstrate the value of the program.

- New technologies to increase precision management and measurement, e.g. ‘fitbit’® sensors to monitor sheep movement and determine parentage. This involves using smart tags (ActiGraph® sensors) to enable lambs to be matched to their ewe mother (this project is in conjunction with Australian Wool Innovation, La Trobe University and Murdoch University) and to determine other uses for ‘smart tags’ that improve efficiency and productivity, including opportunities in feedlots and grazing management.

- Development of new meat products, such as dry-aged mutton from low-value carcases. Engagement with local producers is developing dry-aged mutton products. Dry ageing is a well-established technique used on beef that improves tenderness and flavour. However, the process also reduces the weight of saleable meat. The research project will aim to refine the technique for mutton and to understand the financial parameters associated with dry-ageing mutton.

What is a value chain and why do we need them?

Much of SIBI’s work is based around the concept of value chains rather than supply chains. But how are they different and why do we focus on value chains?

- A supply chain is the physical process of getting a product from the inputs via production through to the end consumer. The service providers along the chain may or may not be consistent and have no investment in achieving a defined outcome for the product. It is usually a transactional arrangement, often developed in relation to cost and convenience.

- A value chain is based on a supply chain. All of the value chain partners invest in ensuring the products are within specification and meet the consumer’s expectations. In a value chain the operation shifts from a transactional level of business to a strategic engagement, where the value chain partners identify and respond to market needs. The value that is created is then apportioned by agreement of the value chain partners, where each of the partners knows the cost of production and the margin that each partner contributes to the end product. This level of transparency is a challenge for many businesses operating in the more traditional fashion. However this transparency is necessary in order to build a resilient and efficient outcome that constantly achieves more profit (or goals that the partners seek) than a supply chain model.

- A value chain is focused on delivering what a customer demands, which is the key to sustainability in any industry. It relies on shared mutual benefit for all value chain partners and their ability to harness the combined efforts to achieve goals that would not be achievable via a supply chain approach. These goals may be reduced risk, increased price, increased volumes, improved product consistency, long-term market relationships, greater efficiencies or many other factors. Many sophisticated markets are demanding the coordination and reliability of a functioning value chain to enhance their confidence in their suppliers.

How are indigenous landowners involved in the SIBI project?

- DAFWA acknowledges the importance of developing partnerships with indigenous landowners. The SIBI project is committed to increasing the participation of indigenous landowners in the WA sheepmeat value chain through the provision of technical and business training opportunities.

- SIBI has developed a partnership with the Southern Agricultural Indigenous Landholder Service (SAILS) team to promote trust and collaboration with indigenous landowners and build capacity. An engagement plan is available in the documents section on the SIBI website.

- In order to build capacity, training programs such as the Lifetime Ewe Management course are being tailored to increase skills on indigenous properties.

How will the impact of the SIBI project on the sheep industry be measured?

- A key activity is to evaluate the success and impact of the SIBI program on the sheep industry throughout the duration of the project. The desired outcome is to grow the WA sheep industry through transformational innovation in market development, value chains and production systems.

- A full impact evaluation plan is available here. The plan, which is regularly updated, includes the expected outcomes and impact of each activity and the ways in which adoption will be measured within the industry. A final evaluation report will be available at the completion of the project in 2018.

The benefits of increasing sheep numbers

Why invest in more sheep?

- The demand from our existing markets for WA sheepmeat is very strong and the WA industry is currently having difficulty in sustainably meeting this demand.

- With a rising middle income population globally the demand for protein will continue to increase in the future, creating further opportunity for the profitability and long-term viability of the WA agriculture sector and the sheep sector in particular.

How will investing in more sheep benefit WA regions and agribusiness?

- A sheep production sector that can reliably meet demand will build confidence in the industry’s future. This will lead to ongoing investment and industry development (including maintenance and upgrading where needed), giving producers, employees and communities confidence while helping to sustain domestic and export markets.

- The agribusiness sector will benefit from increased investment in the regions as a result of the increased confidence generated by the sheep sector and its flow-on effects.

- A sustained and increasing throughput of sheep will result in an increased need for service providers and allied supply chains to manage the increased volume. The strong multiplier effect created by this environment will result in these businesses providing great benefit to WA.

What is the typical flock size in a Western Australian sheep enterprise?

- There are 13.8 million sheep and lambs in WA (2016). The sheep industry contributes almost half of the gross value of agricultural production from all livestock industries in WA. This is made up of $661 million for wool and $513 million for sheepmeat (including live exports).

- Details on the makeup of the sheep flock and the value and quantity of products from the sheep industry can be found on the sheep industry page on the DAFWA website. A dedicated newsletter called Sheep Notes provides a twice-yearly snapshot of the industry.

- The average flock size is larger in the medium rainfall zone than the cereal-sheep zone for both wool production (2240 versus 1671 ewes) and meat production (1367 versus 1042 ewes). Data is from the Western Australian sheep producer survey held in 2011 and 2014.

- Information on the primary enterprise type, mating types, source of rams and use of ASBVs in the 2011 and 2014 surveys can be found in the June 2015 edition of the Ovine Observer while information on parasite control and management can be found in the December 2015 edition of the Ovine Observer. The full report can be found here.

Is the sheep sector stable and is there urgency to act now?

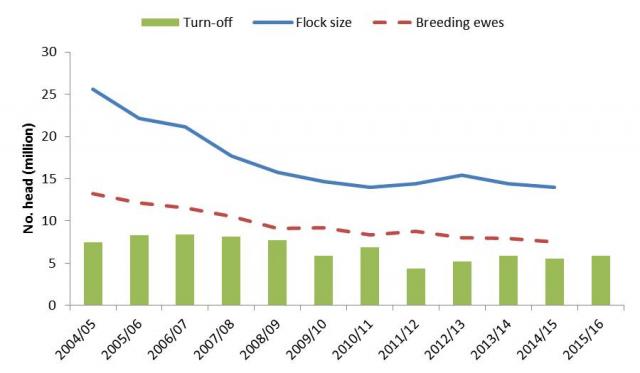

- Yes, there is urgency to act now because annual turnoff from the sheep sector has repeatedly exceeded production resulting in declining flock numbers in recent years. Turnoff is now at or below a level that can sustain the existing processors and exporters. Any further reduction in sheep numbers may limit the ability of the industry to meet the market demand, with subsequent risks to existing markets and there will be fewer marketing opportunities for sheep producers.

- Ultimately the size of the export market prospects highlights the opportunity to increase flock numbers to capture these opportunities. Greater numbers of sheep will result in more efficiencies and greater profitability across the industry.

Will increasing sheep production reduce the price of sheep?

Currently the sheep industry is unable to meet existing demand and emerging markets for WA sheepmeat so the risk of the price of sheep falling is small. To keep and build on these markets sheep production needs to increase. In the long term sheep prices can be sustained with increased production by securing further markets.

Figure 1 Closing number of sheep and lambs, and closing number of breeding ewes in WA and total turn-off for WA (Based on Australian Bureau of Statistics (ABS) data, Department of Agriculture and Food, WA (DAFWA) analysis)

- Loss of markets may occur through product substitution, by other proteins replacing sheepmeat, synthetics replacing wool, and domestically-imported sheepmeat replacing WA lamb. For further information on sheep market trends please view the December 2016 Sheep Notes publication.

- The rapid population growth of wealthy citizens in key markets such as the Middle East and China provides great opportunities for the WA sheep industry. However, to secure these markets the industry has to be able to reliably and sustainably produce the product and avoid these markets being filled by competitors.

Strategies to increase sheep numbers

What are the strategies to increase sheep numbers?

- To meet current demand the industry requires a larger ewe base, an increase in productivity by producing more lambs from the same number of ewes, or a combination of both.

- Increasing productivity by raising lamb marking rates from 83 to 105% will produce sufficient lambs to meet current demand. Demand can also be met by increasing productivity in combination with an increase in the ewe base.

What is the value of an extra lamb?

- There is money to be made producing extra lambs. The Lamb Survival Initiative training program aims to equip producers with the skills to increase lamb survival rates and overall lamb turn-off.

- The number of lambs weaned per hectare is a key profit driver for producers. There will be a cost to producing more lambs, but there are inexpensive ways of achieving this and the return on investment is high.

- A recent analysis showed that while the dollar value of weaning extra lambs will depend on the type of enterprise, it can range from $65 nett per lamb in a Merino system, to $100 nett per lamb in a terminal system.

- Extra lambs also provide extra flexibility in a farming enterprise and more opportunity to produce to market specifications.

What are the benefits of increasing lamb marking rates?

There are three main benefits to increasing lamb marking rates – profit, welfare and business flexibility.

- More profit – Producing more lambs per ewe and per hectare gives producers a higher return on their ewe flock. Whether the lambs are sold for slaughter, sold for live export, sold to other producers, used as replacements, or retained for wool production, there will be more lambs to sell, or less to buy in, and therefore more profit.

- Improved welfare – Managing the flock to increase marking rates reduces ewe and lamb losses, resulting in improved animal welfare outcomes and increasing the value of the flock. The entire industry prioritises the welfare of animals and flock activities to increase marking rates are an extension of that commitment.

- Business flexibility – An increased number of lambs means mean more selection pressure can be applied for greater genetic gain and there is more opportunity to produce to market specifications.

How long will it take to get back into sheep and how much will it cost?

- Due to significant increases in the profitability of sheep, many producers are considering establishing a sheep enterprise or increasing the size of their current enterprise.

- A SIBI commissioned report, The cost of getting back into sheep, examined several scenarios to increase sheep numbers, including increasing lambing percentage, retaining ewes and purchasing ewes. The report explores the time to reach a stable flock size, the year of peak debt and the time to reach break-even.

- The report found that, where high capital investments are possible, purchasing replacement ewes results in a stable flock size earlier than the other scenarios. However, increasing lambing percentage is the most cost-effective option for increasing the flock size and can be achieved through courses promoted by the SIBI project such as the Lifetime Ewe Management program and the Lamb Survival Initiative.

What are the advantages of adding sheep into my farming mix?

- Economic analyses of mixed farming enterprises consistently find that sheep play an important and complementary role in the whole farm business. A recent study based in WA of Comparative enterprise economics showed that the difference in gross margin between sheep and crops is smaller than the difference between individual farm profitability.

- Sheep represent a risk management alternative to crop and provide a dual income stream through wool and sheep sales. Sheep improve productivity through the utilisation of non-arable land and low-quality feed grain, and improve pastures and cropping through weed control and nitrogen deposition.

What is the most profitable sheep enterprise?

- There is no “most profitable” sheep enterprise because the largest driver of profitability is stocking rate, independent of breed. The gross margin for cross bred prime lamb is generally higher than for Merinos or Non-shearing sheep, however there is significant variation in these results between individual farms.

- Management practices are a greater profit driver than the type of enterprise and with appropriate management each enterprise can perform equally well. Further information can be found in the Comparative enterprise economics study.

Are there labour-saving technologies to make increasing sheep production more feasible?

- New on-farm technologies have an important role in improving labour efficiency, and for sheep traceability and breeding, making sheep production more efficient and increasing turn-off.

- A SIBI Pilot group for New Technology was formed in 2016 to support sheep producers by increasing their knowledge and experience of new technologies through field visits, demonstrations and on-farm testing. The technologies have included cameras for remote water source monitoring, new sheep handling equipment, pedigree matchmaker and a WiFi drench gun.

- The value of each new technology varies between enterprises depending on the size of the property, number of sheep, market and breeding requirements and farm infrastructure. An economic analysis and a case study on the use of remote cameras for water source monitoring are available in the documents section on the New on-farm technology for sheep producers webpage.

Business innovation and opportunities

Are there new business models that will make the WA sheep industry more profitable?

- Business models are currently evolving to meet the needs of all members of the supply chain and improve the sustainability of those businesses.

- In many cases efficiencies of scale can’t be achieved with existing levels of investment. Smaller enterprises that are looking to capitalise on demand may look toward forming joint ventures or partnerships.

- The development of a range of innovative business models with robust financial modelling will also support increased confidence. A report on alternative investment models “Concepts for alternative investment and financing models to expand sheep production in Western Australia” summarises the opportunities. The follow up report, “Sheep Industry Business Model Development”, explores four of the investment models in more detail.

What role can contracts play in making sheep businesses more profitable and resilient?

- Contracts give producers some visibility on future lamb and wool prices which provides confidence to invest in their business and retain lambs to build flock numbers. Contracts also allow producers to lock in a future price for their lambs and manage the farm system to maximise profit.

- Processors can utilise agreements to book in kill space, secure supply and manage sales to meet profit targets.

- Enforceable contracts to supply or forward contracts are used by the cropping industry and provide certainty of returns for both growers and traders. Processors in other livestock industries are also driving the move to contracts, which facilitates increased investment in production and processing.

Are carry-over lambs a profitable business model?

- The lamb production system in WA is characterised by a large supply of lambs finished on green feed during spring and then a reduction in supply through summer, autumn and winter. This pattern of supply reflects the cost of finishing the lambs, with it being cheapest finishing on green feed and progressively more expensive as the season progresses.

- It would be advantageous for the processing sector to have a more even supply of lambs through the season, because this would allow them to supply markets on a consistent basis through the year and to better utilise the capital invested in abattoir facilities.

- Higher prices are offered for out-of-season lamb, however, historically these premiums have not been sufficient to entice farmers away from the sucker lamb production system.

- A price cost analysis for out of season lamb production in WA was commissioned by the SIBI project and showed that the sucker system is the lowest cost system, while the carry-over system requires a higher price in order to have equal profitability. The later lambs are turned-off, the higher the price required to break even, generally being $4.50/kg to $5.00/kg over the hooks.

- The price increase required to make equal profit from turning off lambs one month later is greater than the 5 year average increase in price per month. However, a strong forward pricing mechanism may help manage the risk of turning lamb off later.

What training is available to increase business skills?

- Increasing business skills both on-farm and within the value chain is a focus of the SIBI project.

- Opportunities to increase on-farm business skills are regularly promoted on the SIBI website and associated publications including the SIBI newsletter and Ovine Observer. Examples include Sheep Updates, the SIBI agribusiness professional development training days and feedlotting decisions workshops, and the promotion of training opportunities such as the Lifetime Ewe Management program, Bred Well Fed Well workshops, RamSelect workshops and the Lamb Survival Initiative.

- To increase business skills within the value chain a number of training and scholarship programs have been developed. To see more details visit the webpage. Each program is focused on interaction with supply chain partners and may in the future include industry placement opportunities.

- For example, a one-week value chain training course was held in January 2017 to increase the skills of people employed in the sheepmeat value chain. Participants were early in their careers in the agricultural industry and included agricultural students, consultants and advisors.

How can we attract more capital investment into the sheep industry?

- The WA sheep industry is an exciting sector to be involved in. By creating an agreed industry vision of a confident, future-focused and profitable industry with a strong future, the industry will be able to exhibit a high level of sustainability and resilience, which are attractive attributes for investors, both public and private.

- Independent reports such as Deloitte “Building the Lucky Country: Positioning for Prosperity” named agribusiness as one of the ‘fantastic five’ key drivers of growth opportunities for the Australian economy into the future. Of all the sectors in the Australian economy, agribusiness was the sector with the strongest combination of competitive advantage and producing what the world increasingly wants. Within agribusiness sheep was seen to be the second strongest driver of opportunity.

- The development of tools that can build a full picture of the industry sector will identify strengths of the industry which can be built on to attract capital investment. The proposed SIBI project to map the existing sheep supply chain for inputs and outputs is an example. Modelling with this information can determine how to increase efficiency, plan for expansion or minimise cost and waste. Further information on identifying potential cost savings can be found here.

- The development of a range of innovative business models with robust financial modelling will also support increased confidence and is planned for the final year of the SIBI project. Further information on alternative investment models can be found in the report “Concepts for alternative investment and financing models to expand sheep production in Western Australia”.

- At an enterprise level, businesses should ensure they seek professional advice to meet investor needs. This includes well-maintained documents outlining business structure, financials, cash flow, risk management and future plans. Corporate investors often look to invest in large operations, so it could be worth entering into discussion with contemporaries who may be interested in amalgamation to build scale.